Advertisement|Remove ads.

HDFC Life Earnings Show Operational Strength, SEBI Analyst Sees Bounce Potential

HDFC Life shares fell nearly 2% despite the insurer delivering steady September quarter (Q2 FY26) earnings, despite muted investment income.

Net profit rose 10% year-on-year (YoY) to ₹415 crore in Q2, with 8% growth in value of new business (VNB) and 10.5% rise in new business premiums (NBP).

SEBI-registered analyst Financial Sarthis noted that the positives included gains in VNB margins to 24.1%, steady earnings growth, and management’s commentary on long-term growth prospects. They remain bullish on growth post-GST reform, expecting robust demand & margin improvement in H2 FY26.

The analyst noted that the miss on NBP, as well as lower incom,e weighed on sentiment. Despite margin softness & lower investment gains, HDFC Life continues to deliver solid operational performance, backed by strong value creation (VNB +8%) and stable profitability (+10%), according to Financial Sarthis.

HDFC Life: What are technical charts suggesting?

They noted that HDFC Life was respecting its long-term rising trendline support, while consolidating near key Fibonacci retracement levels. Volume remains moderate, suggesting a phase of quiet accumulation rather than panic selling.

Financial Sarthis said that holding the ₹735–₹740 zone could trigger a bounce, and advised traders to watch for a rebound.

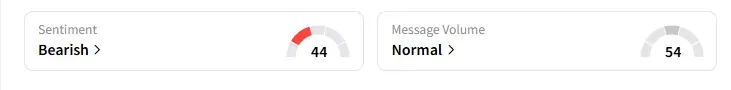

HDFC Life: What is the retail sentiment on Stocktwits?

Data on Stocktwits showed that retail sentiment has been ‘bearish’ for a week now.

HDFC Life Insurance shares have risen 21% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)