Advertisement|Remove ads.

These 3 Healthcare Stocks Show Serious Muscle Amid Trump Tariff Turmoil: Are Retail Traders Feeling Bullish?

U.S. stock markets spiraled lower last week as President Donald Trump's sweeping reciprocal tariffs rattled global investors.

But while tech and industrials bore the brunt of the selloff, healthcare stocks showed surprising resilience — living up to their reputation as a defensive haven during periods of economic uncertainty.

Here are three names from the sector that stood out with staggering weekly gains, offering retail traders on Stocktwits a rare dose of optimism in an otherwise chaotic week:

iCoreConnect Inc (ICCT) - 1,579% weekly gain

Ocoee, Florida-based iCoreConnect offers software-as-a-service for the healthcare market. Last week, there were no major news catalysts for the stock, although it has seen heavy trading volume since the beginning of April.

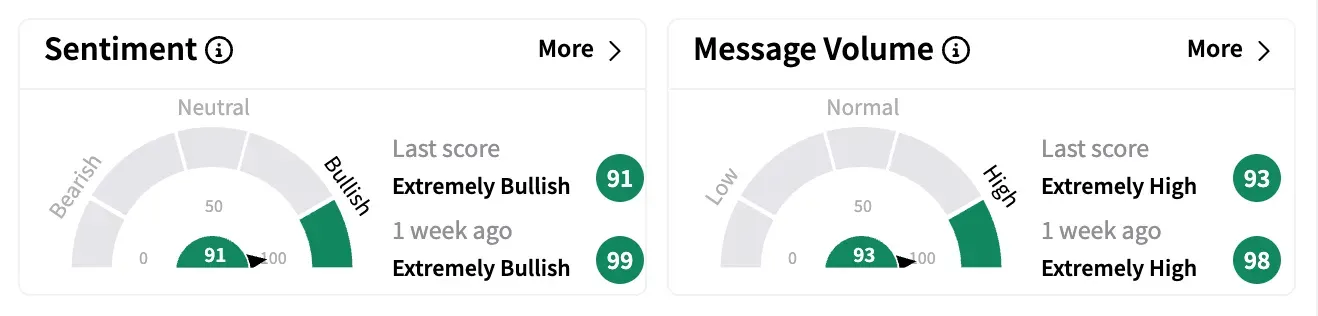

On Stocktwits, sentiment remained 'extremely bullish' last week amid stunning gains, with followers jumping by 69% and message volume exploding by over 40,400%.

Recent posts suggest that retail traders anticipate a major development, though many dismissed the possibility of another equity offering —something the company has done multiple times.

Last year, the company received the backing of several state dental associations for its cloud solutions and made some strategic acquisitions.

BioAffinity Technologies Inc (BIAF) - 163% weekly gain

San Antonio, Texas-based BioAffinity is a company focused on making products for the early detection of cancers. Its initial product, CyPath Lung, uses a patient's sputum and proprietary automated flow cytometry data analysis to diagnose early-stage lung cancer accurately.

Last week, Maxim — the sole research firm covering the stock — downgraded BioAffinity to 'Hold' from 'Buy' after the company posted annual financial results.

BioAffinity's 2024 revenue increased 270% from a year earlier, primarily due to the acquisition of Precision Pathology Laboratory Services (PPLS). However, the company's net loss also increased due to higher operating expenses.

In March, BioAffinity said it expects to realize most of its planned $4 million in annual cost savings through workforce and operational cuts at PPLS and improving operational efficiency by cutting supply and service costs.

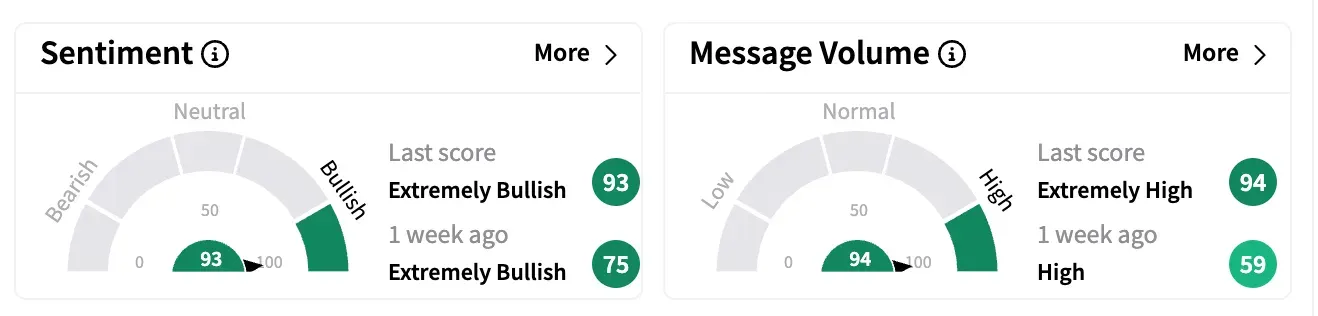

On Stocktwits, sentiment ended Friday higher in the 'extremely bullish' zone amid a 3,750% spike in weekly message volume.

Alaunos Therapeutics Inc (TCRT) - 102% weekly gain

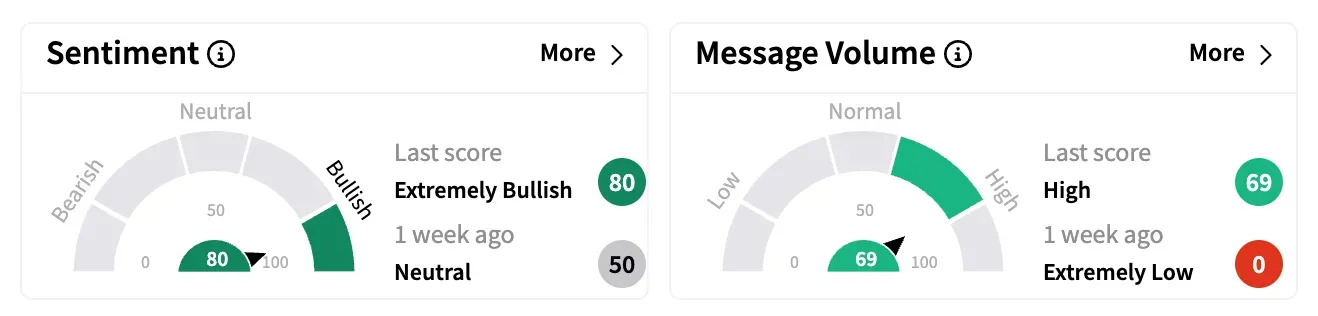

Houston, Texas-based Alaunos is a biotech firm that also rocketed last week with virtually no major news catalysts, with Stocktwits sentiment flipping to 'extremely bullish' from 'neutral.'

Regulatory filings from April 1 revealed that senior executives, including interim CEO Dale Curtis Hogue, exercised options to buy 7,000 shares at $1.46 apiece.

The company's annual 10-K report also showed that Alaunos' 2024 revenue doubled to $10,000, while net loss shrank to $4.6 million from $35.1 million a year earlier.

Alaunos significantly cut expenses by winding down clinical programs, such as its costly TCR-T clinical trial, and reducing headcount.

The company is exploring strategic options such as mergers, partnerships, or asset sales.

Alaunos is now focused on its small molecule oral obesity drug program, which aims to offer a differentiated alternative to injectable GLP-1 therapies by preserving lean muscle mass.

Alaunos regained Nasdaq compliance in February and expects its current cash reserves to last into the second quarter.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_540198451_jpg_3e5f3d8ee7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202831815_jpg_e9c998f956.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_b1a99c6298.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243572319_jpg_90770a5e51.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_Social_logo_1200_Px_resized_jpg_86883cac04.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2243387433_jpg_9712a99e81.webp)