Advertisement|Remove ads.

Hewlett Packard Enterprise Nosedives On Mixed Q1, Weak Guidance: Retail Uses Dip To Accumulate ‘Value’ Stock

Hewlett Packard Enterprise Company (HPE) shares came under intense selling pressure in Thursday’s after-hours session after the edge-to-cloud company announced mixed quarterly results and plans to cut jobs amid softness in the server business. The forward guidance also trailed expectations.

The Houston, Texas-based company reported adjusted earnings per share (EPS) of $0.49 for the first quarter of the fiscal year 2025, trailing the Finchat-compiled $0.50-per-share consensus estimate.

However, the bottom-line result improved from the year-ago quarter’s $0.48 per share, and aligned with the company’s previously guided range of $0.47-$0.52.

Revenue grew 16% year over year (YoY) to $7.9 billion, rising above the average analysts’ estimate of $7.81 billion. The YoY revenue growth quickened from the fourth quarter’s 15%.

Among the business segments, Server revenue, accounting for about 54%, climbed 29% to $4.3 billion, slower than the 32% rise in the previous quarter. Hybrid cloud revenue rose 10% to $1.4 billion versus the previous quarter’s 18% growth.

Intelligent edge revenue was $1.1 billion, down 5%, slower than the 20% drop in the fourth quarter.

Non-GAAP gross margin contracted 680 basis points YoY to 29.4%.

CEO Antonio Neri said, “HPE achieved our fourth consecutive quarter of year-over-year revenue growth, increasing revenue by double digits in Q1.”

Hewlett Packard Enterprises’ board declared a regular cash dividend of $0.13 per share, payable on April 18, to shareholders as of the close of business on March 21.

The company estimates second quarter adjusted EPS in the range of $0.28 to $0.34 and revenue in the range of $7.2 billion to $7.6 billion. The numbers missed the consensus estimates of $0.50 and $7.93 billion, respectively.

For the full year, the company guided to adjusted EPS of $1.70 to $1.90 and revenue growth of 7% to 11% in constant currency.

Analysts, on average, estimate the bottom-line result of $2.13 and currency unadjusted revenue growth of 7.99%.

On the earnings call, CFO Marie Myers said the company anticipates server revenue to slow to low double-digit growth in 2025, with artificial intelligence (AI) systems revenue ramping meaningfully in the back half.

Giving an update on its impending merger with Juniper Networks, Inc. (JNPR), Hewlett Packard Enterprises said the companies have filed answers to a Department of Justice (DOJ) complaint filed on Jan. 30, seeking blocking of the proposed combination.

In an 8-K report filed with the SEC, the company said its board has approved a cost reduction program involving the elimination of jobs. The program will run through the fiscal year 2026 and deliver gross savings of $350 million by 2027.

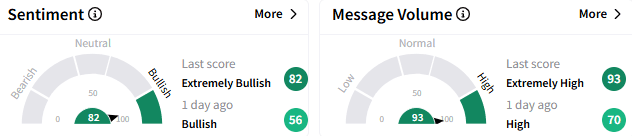

On Stocktwits, retail sentiment surrounding Hewlett Packard Enterprise stock turned to ‘extremely bullish’ (82/100) from the ‘bullish’ mood seen a day earlier. The message volume perked to ‘extremely high’ levels.

A bullish watcher remarked the results weren’t bad and that Hewlett Packard Enterprise is a ‘value’ stock.

Another said they accumulated the stock on its dip, given the “impressive” $1 billion free cash flow, 9% revenue growth guidance despite full impact of tariffs and the attractive valuation.

Hewlett Packard Enterprise stock plunged 20.21% to $14.33 in after-hours trading. The stock is down about 16% so far this year.

If the after-hours losses carry over to Friday’s session, the stock is on track to witness the biggest single-day drop since April 2017, according to Koyfin.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stocks_jpg_a3427ddfd2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1900667440_jpg_c3b8e52a81.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1207431426_jpg_b8d7c6d852.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_rigetti_computing_quantum_computer_representative_resized_bafe11454b.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_red_cat_holdings_representative_resized_071bc0311e.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)