Advertisement|Remove ads.

Here’s What Goldman CEO Said On Acquisitions In Asset And Wealth Management, Trump Administration’s Growth Agenda

Goldman Sachs Group Inc (GS) CEO David Solomon reportedly said the bank would consider asset and wealth management acquisitions but would be very selective in choosing a deal.

"If we could find things that could accelerate our asset and wealth management journey, we would consider them," said Solomon, speaking at the Miami UBS financial services conference, according to a Reuters report. "But the bar to do significant things is very, very high.”

During the fourth quarter, net revenues in the Asset & Wealth Management division rose 8% year-over-year to $4.72 billion, primarily reflecting higher management and other fees, significantly higher incentive fees, and higher net revenues in private banking and lending.

It was partially offset by significantly lower net revenues in debt investments and lower net revenues in equity investments.

Notably, Goldman Sachs’ net income more than doubled to $4.1 billion during the quarter. Solomon had highlighted that the bank met or exceeded almost all of the targets set in its strategy to grow the firm five years ago.

At the UBS conference, Solomon said he expects a more growth-oriented agenda from President Donald Trump's administration, although the policy direction is a bit more complicated. "The regulatory environment should be a constructive tailwind, but the broad policy landscape is still uncertain," he said, according to the Reuters report.

The Goldman CEO noted that a lot of policy is shifting, and until there’s more certainty about that policy, that's going to create a little bit of volatility.

At the same time, Solomon believes the market is undervaluing the bank’s trading unit and urged investors to consider a longer-term view of the business, according to a Bloomberg report.

“If everyone would step back and stop looking at it on a quarter-to-quarter basis and start looking on a year-to-year basis, it is a huge globally scaled platform with a big, big diverse array of businesses,” Solomon said, according to the report.

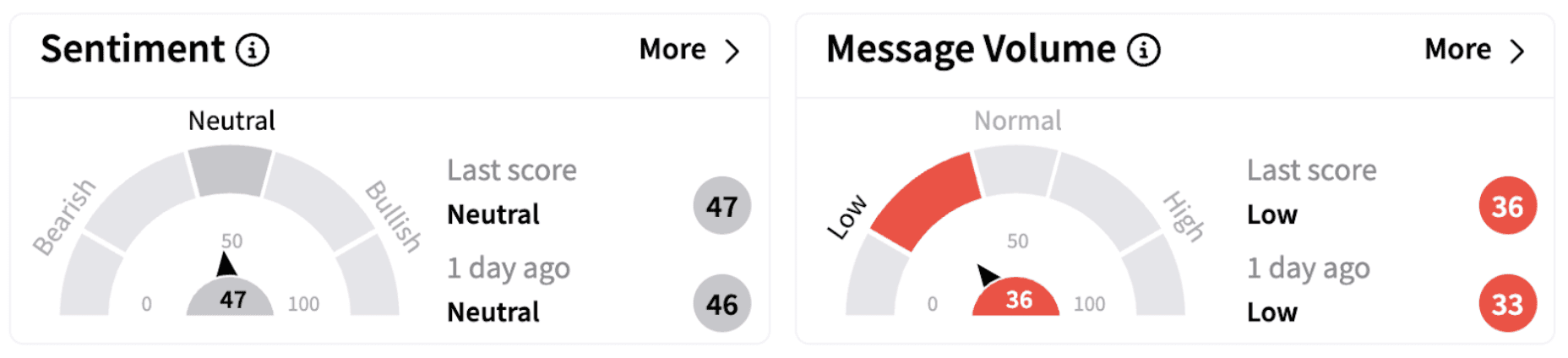

Meanwhile, on Stocktwits, retail sentiment on Goldman Sachs continued to trend in the ‘neutral’ territory (47/100).

Goldman shares traded nearly 1% lower on Tuesday. The stock has gained over 12% in 2025 and has risen over 64% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_stocks_war_jpg_f2a208ae56.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_M_and_A_deals_acquisitions_resized_jpg_a56d5b5e28.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_semtech_logo_resized_jpg_f9b0e1e71e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ross_stores_resized_jpg_e7e996e005.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2252956558_jpg_2dc0e5e537.webp)