Advertisement|Remove ads.

Powell Says Fed Doesn’t Need To Be In A Hurry To Cut Rates: ‘Attentive To The Risks To Both Sides Of Our Dual Mandate’

Federal Reserve Chair Jerome Powell stated before the Senate Banking Committee that the central bank does not need to be in a hurry to cut interest rates and noted that while inflation has come down significantly, it is still above the 2% target.

“With our policy stance now significantly less restrictive than it had been and the economy remaining strong, we do not need to be in a hurry to adjust our policy stance. We know that reducing policy restraint too fast or too much could hinder progress on inflation,” Powell said in his prepared remarks. “At the same time, reducing policy restraint too slowly or too little could unduly weaken economic activity and employment.”

Although there is a lot of talk about the impact of President Donald Trump’s tariff impositions, Powell refrained from talking about the subject in his remarks, although questions surrounding the topic are expected from panel members.

“We are attentive to the risks to both sides of our dual mandate, and policy is well positioned to deal with the risks and uncertainties that we face,” Powell said.

The Fed Chair also defended the recalibration of the central bank’s policy stance, saying it was appropriate in light of the progress on inflation and the cooling in the labor market.

Powell also said the Fed will conduct the second periodic review of the monetary policy strategy, tools, and communications and asserted that the Federal Open Market Committee’s 2% longer-run inflation goal will be retained and will not be a focus of the review.

In a recent note, Morgan Stanley said it expects January 2025 core consumer price index (CPI) print at 0.37%, significantly above the December 2024 figure. Headline CPI inflation is expected to come in at 0.35% month-on-month.

The company attributed the acceleration to the effect of wildfires and seasonality issues that tend to add an upward bias to inflation. However, the annual core CPI figure is expected to come in line with the December reading of 3.2%.

“We still expect high used and new car inflation because of wildfires, and acceleration in certain goods that seem to show strength in January (drugs, motor vehicle parts, recreation commodities),” Morgan Stanley said in a note.

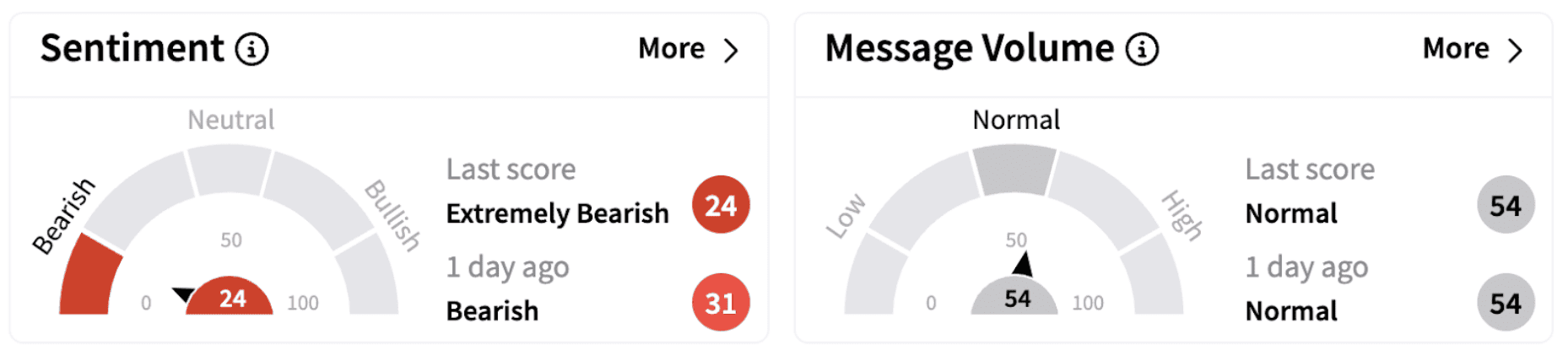

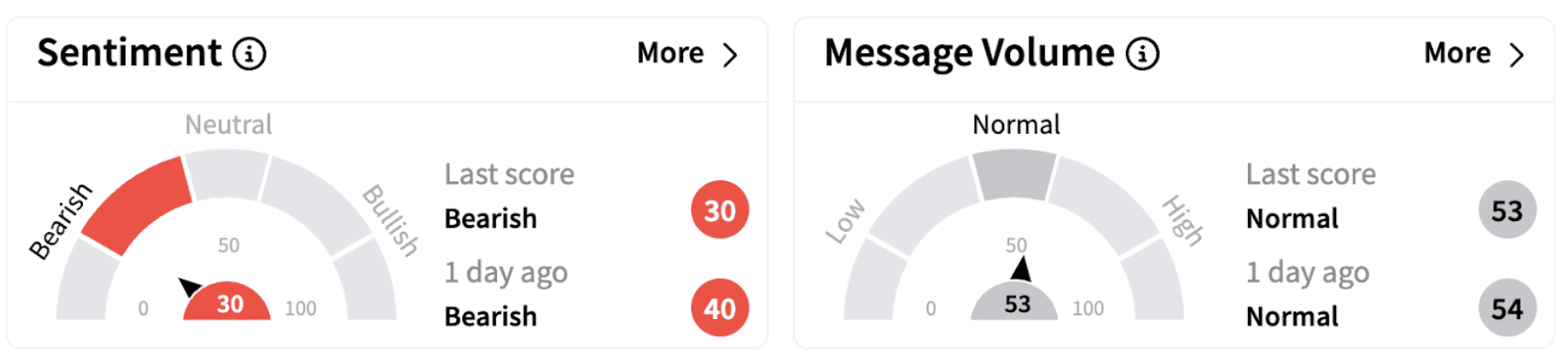

On Tuesday, major Wall Street indices did not see any major movement with the SPDR S&P 500 ETF Trust (SPY) and the Invesco QQQ Trust Series 1 (QQQ) trading marginally in the red. Retail sentiment for these ETFs trended in the ‘bearish’ territory on Stocktwits.

Investors are now eyeing the consumer price index (CPI) data scheduled to be released on Wednesday.

The SPY gained nearly 3.5% in 2025, while the QQQ rose nearly 4% in the same period.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_stocks_war_jpg_f2a208ae56.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_M_and_A_deals_acquisitions_resized_jpg_a56d5b5e28.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_semtech_logo_resized_jpg_f9b0e1e71e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ross_stores_resized_jpg_e7e996e005.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2252956558_jpg_2dc0e5e537.webp)