Advertisement|Remove ads.

Here's Why Dan Ives Called Elon Musk A ‘Wartime CEO’ Ahead Of Tesla’s Q2 Earnings

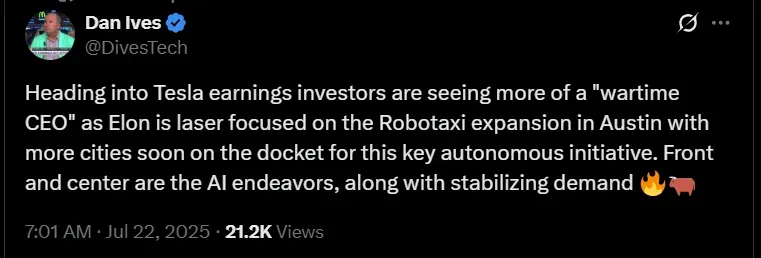

Tesla (TSLA) investors are bracing for a pivotal earnings report this week, with Wedbush analyst Dan Ives describing Elon Musk as a “wartime CEO” who is sharply focused on high-stakes initiatives.

Tesla’s stock edged 0.16% higher in pre-market trade on Tuesday. On Stocktwits, retail sentiment around the EV maker improved to ‘bullish’ territory from ‘neutral’ a day before. However, chatter remained subdued at ‘low’ levels.

At the center of investor attention ahead of Wednesday’s earnings is Tesla’s push into autonomous vehicles, with a Robotaxi rollout underway in Austin and plans to expand to additional cities.

In a post on X, Ives said Musk is “laser focused” on scaling the Robotaxi effort, which he views as critical to Tesla’s long-term AI strategy. The company is also working to stabilize demand after a rocky first half of the year marked by price cuts and increased competition.

“Front and center are the AI endeavors, along with stabilizing demand,” he wrote.

Meanwhile, JPMorgan’s head of global automotive research, Jose Asumendi, tested Tesla’s robotaxi service in Austin for a full day. According to TheFly, he felt the experience was "certainly solid and felt like a safe ride at all times."

In a note to investors on Tuesday, Asumendi stated that the future of Tesla's robotaxi rides and others operating in the field will be based on traffic and accident-free data. The firm said it believes robotaxis could boost the pricing power of new car sales.

Tesla’s stock has fallen more than 15% this year and 34% over the past 12 months. The company is scheduled to report earnings on Wednesday, with Wall Street expecting earnings of $0.39 per share on revenue of $22.19 billion.

Read also: SpaceX, Perplexity Investor Glade Brook Raises $515 Million To Back AI and Space Startups

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_OG_2_jpg_f92901a0f5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786698_jpg_4d7b65921f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Shift4_logo_jpg_jpg_1845f04c23.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ras_tanura_jpg_b79d6fe085.webp)