Advertisement|Remove ads.

Hexcel Stock Falls After 2025 Forecast Cut, Q1 Profit Miss On Commercial Aviation Weakness: Retail’s Split

Hexcel (HXL) stock fell 2.5% in extended trading on Monday after the aerospace materials firm cut its 2025 forecast after posting first-quarter earnings below Wall Street’s estimates.

On an adjusted basis, the company reported earnings of $0.37 per share for the quarter ended March 31, while analysts expected it to post $0.42 per share, according to FinChat data.

The company reported net sales of $456.50 million for the first quarter, which fell short of Wall Street’s expectations of $474.73 million.

Its Commercial Aerospace segment sales fell 6.1% to $280.1 million due to weaker demand from lower Boeing 787 and MAX sales.

Hexcel’s Defense, Space, and Other sales rose 2% to $176.4 million, driven by several military programs, including the CH-53K and Black Hawk helicopters.

“As a result of continued supply chain-driven delays in commercial aircraft production rate ramps, particularly on the Airbus A350 program, our 2025 growth will not be what we initially forecasted,” CEO Tom Gentile said.

The company, one of the biggest suppliers of carbon fiber to aircraft companies, forecasts 2025 sales in the range of $1.88 billion to $1.95 billion compared with $1.95 billion to $2.05 billion projected earlier.

Hexcel also forecast full-year adjusted earnings between $1.85 and $2.05 per share compared with the earlier range of $2.05 to $2.25 per share. Neither forecast takes into account the impact of tariffs.

“Our current headcount is roughly 100 individuals lower than December 31 and about five percent lower than our 2025 planning had previously targeted for the end of March,” Gentile said.

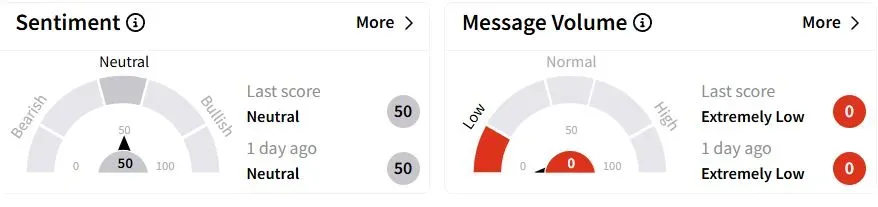

Retail sentiment on Stocktwits was in the ‘neutral’ (50/100) territory, while retail chatter remained ‘extremely low.’

One retail trader said the earnings report wasn't the worst, but it wasn't bullish either.

Hexcel shares have fallen 19.9% year to date (YTD).

Also See: US Recession Inevitable If High Tariffs Remain, Apollo’s Top Economist Warns

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)