Advertisement|Remove ads.

Hims & Hers Stock Sinks After-Hours As Weight-Loss Roadmap Gets Clouded — Retail Pounces On The Dip

Hims & Hers Health Inc. shares plunged over 18% in after-hours trading on Monday after the telehealth company reported strong quarterly results but signaled hurdles for its compounded weight-loss drug business.

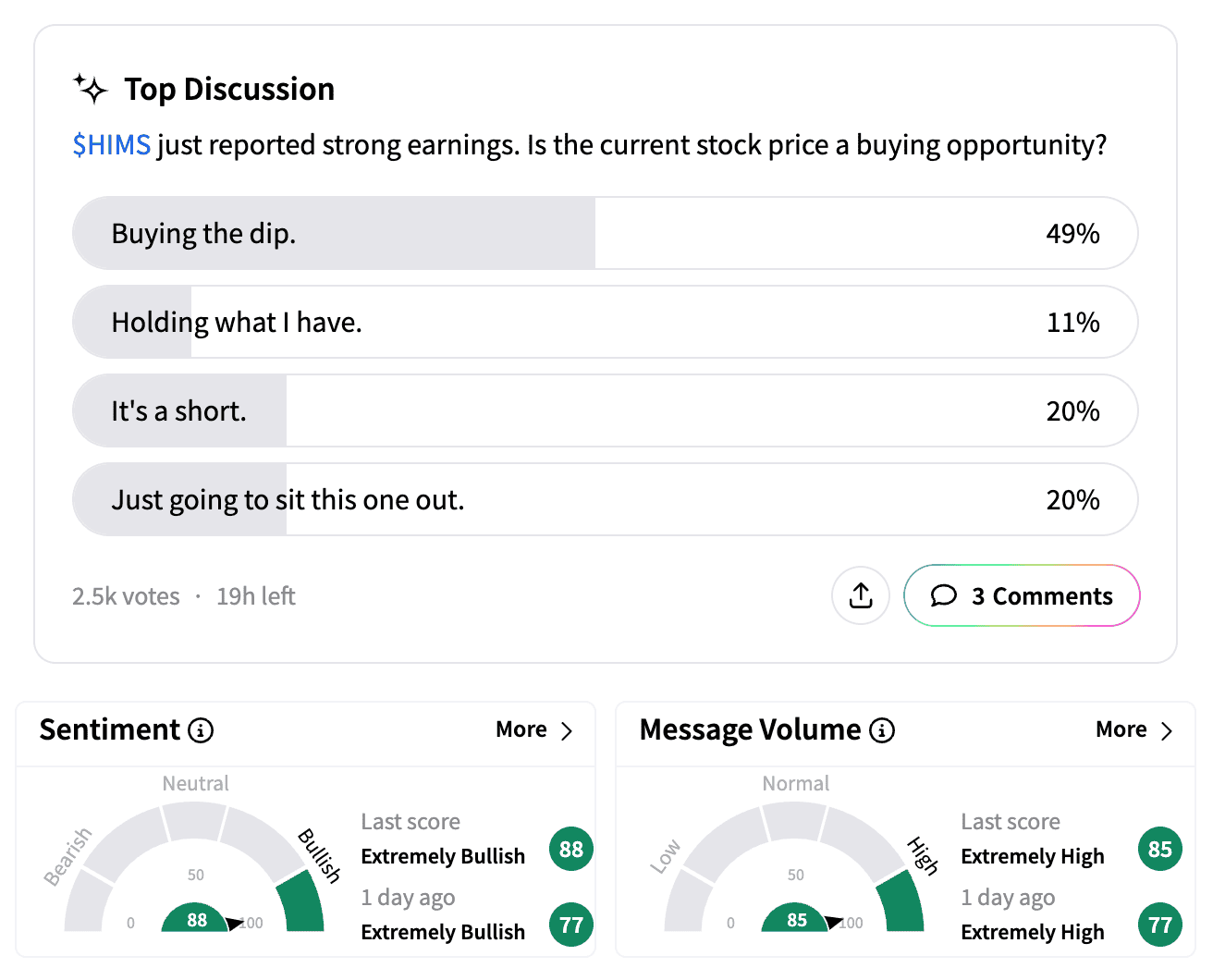

Despite the drop, retail sentiment remained resilient on Stocktwits, with many traders signaling they were buying the dip.

The company beat analyst expectations on revenue, posting $481.1 million in fourth-quarter sales (vs. estimates of $470.4 million), while adjusted earnings per share (EPS) of $0.11 aligned with forecasts.

Sales guidance for 2025 came in strong at $2.3 billion-$2.4 billion, well above Wall Street's $2.09 billion projection.

However, CEO Andrew Dudum confirmed that Hims will stop offering compounded semaglutide — the active ingredient in Wegovy and Ozempic — after Q1, following the U.S. Food and Drug Administration’s (FDA) recent determination that the drug shortage is over.

On the earnings call, Dudum acknowledged that the transition would be "inevitable" for patients currently on compounded semaglutide.

"Obviously, we have the expansive platform ... But I would suspect, just being very direct, that a lot of those patients will try to go into the open market and try to secure a branded option in some form factors."

While this announcement sent the stock tumbling after-hours, Hims' retail investor base remained upbeat.

A Stocktwits poll of over 2,400 traders showed that 49% were buying the dip, while 40% planned to short the stock or stay on the sidelines.

"People really think Hims spent all that money on a Super Bowl ad for a few months of GLP-1 drug sales… ridiculous," one user wrote, referring to Hims' recent controversial commercial targeting Big Pharma and the weight-loss industry.

Another user said the company "just delivered a massive quarter and guided to a huge re-acceleration in QoQ growth."

Hims & Hers projected Q1 revenue of $520 million–$540 million, well above Wall Street's $494.6 million forecast, and said adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) would come in at $55 million–$65 million.

On the earnings call, CFO Yemi Okupe emphasized that Hims' business outside of the weight-loss segment remains strong, saying non-GLP-1 revenue surged 43% year-on-year to $1.2 billion in 2024.

"Our belief is that lab diagnostics will unlock a greater breadth of personalized treatments, which will further expand the runway for growth across our existing specialties," he added.

Dudum said partnering with branded GLP-1 manufacturers — similar to the recent Ro Health-Eli Lilly tie-up — was "not off the table" but cited supply challenges and declining reimbursement rates as obstacles to offering a scalable solution.

Hims still expects its weight-loss segment to contribute at least $725 million in revenue for 2025, excluding compounded semaglutide.

As of Monday's close, Hims & Hers' stock had more than doubled in 2024. According to Koyfin data, the stock also has a high short interest of 26.6%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)