Advertisement|Remove ads.

Hims & Hers Retail Traders Eye Robust Post-Earnings Rebound Following Stock’s Worst Drop On Semaglutide Update

Hims & Hers Health Inc. (HIMS) stock tumbled over 25% on Friday, extending losses in after-hours trading after the U.S. Food and Drug Administration (FDA) officially resolved the semaglutide shortage.

The stock's steepest single-day drop came as Novo Nordisk (NVO), which manufactures Ozempic and Wegovy with semaglutide as the active ingredient, gained over 5%.

Hims & Hers sells compounded versions of semaglutide-based weight-loss drugs, which the FDA permits only during a national shortage.

However, the agency clarified that it would not take immediate action against compounders to avoid disrupting patient treatments while reserving the right to address quality or safety concerns.

Despite the drop, retail traders on Stocktwits anticipate a strong recovery, fueled by the company's upcoming after-hours earnings report on Monday.

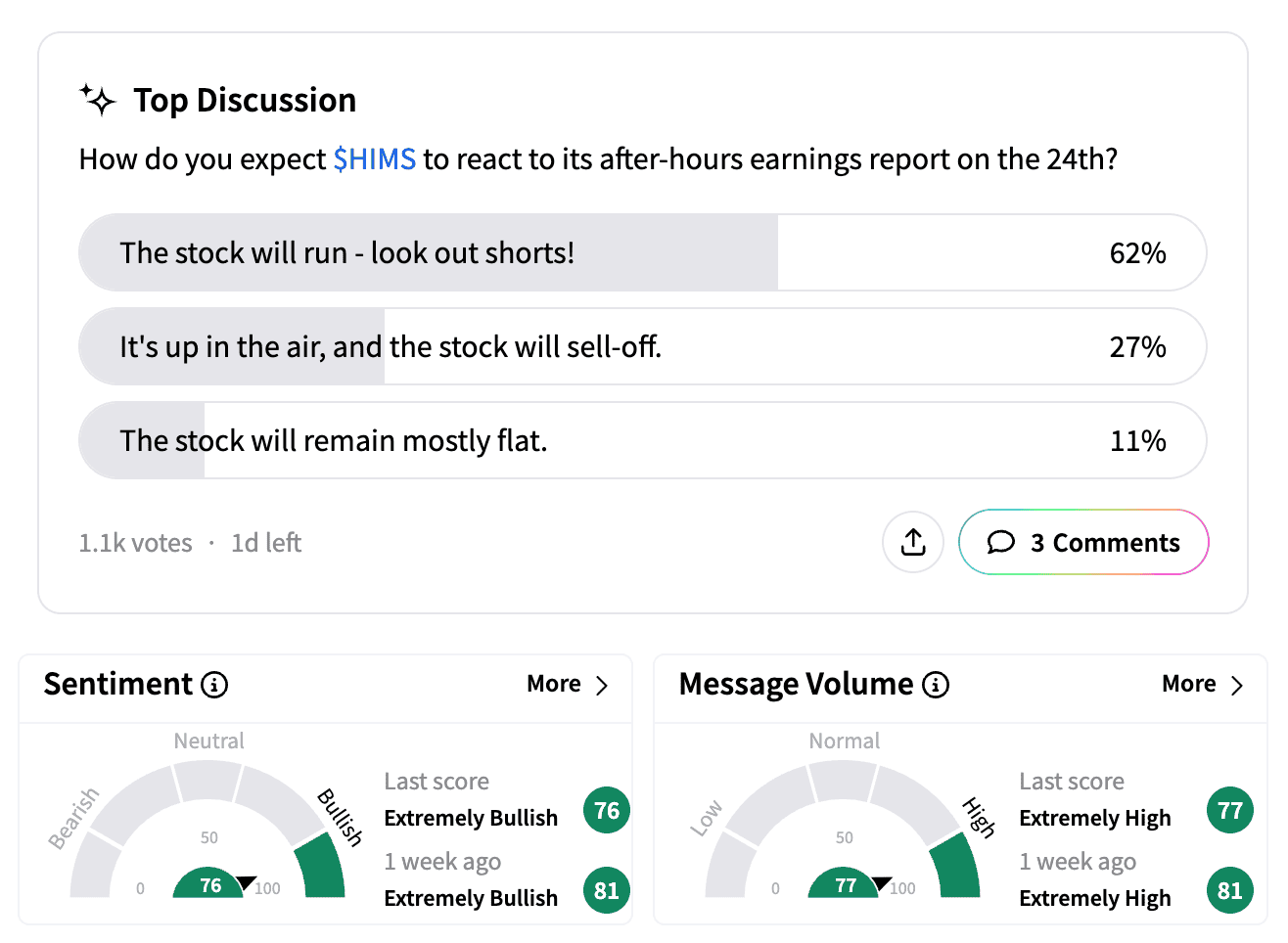

A Stocktwits poll on HIMS found that 63% of over 1,100 respondents expect the stock to "run," while 26% believe it's uncertain and could sell off, and 11% predict it will stay mostly flat.

Sentiment for HIMS remained 'extremely bullish' on Friday, with message volume surging 65% over the past week.

One optimistic trader predicted a sharp rebound to $60, calling HIMS "a hyper-growth stock."

Another emphasized Hims & Hers' broader platform strategy, stating that its weight-loss drug segment was not "the be-all and end-all" and that the stock is a "strong long-term hold."

Adding to investor optimism, CEO Andrew Dudum acknowledged retail shareholders in a Twitter (now X) post, highlighting their deep research on the company and announcing plans to engage them directly on future earnings calls.

After Monday's market close, Wall Street will closely watch Hims & Hers' fourth-quarter (Q4) earnings. Analysts expect adjusted earnings of $0.10 per share on revenue of $469.68 million.

Leerink noted that the end of the semaglutide shortage "starts the clock on having unfettered market access to the patented drug" and stressed that the company's legal pathway for selling personalized doses would be crucial.

The research firm maintains a 'Market Perform' rating on HIMS and anticipates further clarity from the earnings call.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_kevin_warsh_jpg_0c2cd19926.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robotaxi_Tesla_jpg_209f017098.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tariffs_jpg_d7661eb31a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347257_jpg_81c3539d3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2204003106_jpg_405e036a7c.webp)