Advertisement|Remove ads.

Hecla Mining Forecasts Lower 2026 Silver Output – But HL Stock Rises On Record Silver Rally

- Hecla expects consolidated silver production of 15.1 to 16.5 million ounces and gold output of 134,000 to 146,000 ounces in full-year 2026.

- Despite the lower volumes, Hecla expects to maintain strong silver margins, with consolidated silver total cost of sales guided at $471 million.

- Meanwhile, Avino Silver and Gold Mines said drill results for its La Preciosa project in Mexico, exceeded grade expectations.

Hecla Mining (HL) said on Monday that it expects consolidated silver production of 15.1 to 16.5 million ounces and gold output of 134,000 to 146,000 ounces in full-year 2026, just below its 2025 output, when the company produced 17 million ounces of silver and 150,509 ounces of gold.

Hecla said the outlook reflects lower milled-grade expectations at the Greens Creek and Casa Berardi operations.

Despite the lower volumes, Hecla expects to maintain strong silver margins, with consolidated silver total cost of sales guided at $471 million. The company noted that sustained strength in metal prices could allow it to outperform this cost guidance.

HL shares jumped more than 7% in premarket trading and are set to open at their highest level since September 1980, lifted by silver’s record surge that pushed the precious metal above $110 an ounce for the first time.

Cost Guidance

Hecla outlined cost and investment guidance across its key operations. At Greens Creek mine, the total cost of sales is expected to be $287 million, largely flat from the previous year. Total cost of sales from the Lucky Friday mine is projected at $184 million, reflecting higher profit-sharing payments tied to strong silver prices. At Casa Berardi, the total cost of sales is expected to decline to $192 million, Hecla added

Avino’s Drilling Test Results

Meanwhile, Avino Silver and Gold Mines (ASM) reported test results for six drill holes totaling 1,400 metres at the La Preciosa project in Mexico. The drilling program includes 14 holes covering about 3,500 metres. All six holes hit the main La Gloria and Abundancia veins, along with several additional veins. The company said the drill results exceeded grade expectations.

“The silver grade continues to surprise to the upside with significantly higher silver grades compared to the average grade in our current mineral resource,” said David Wolfin, President and CEO of Avino.

ASM stock was up 9% in pre-market trading to its highest since September 1985.

Retail Reaction

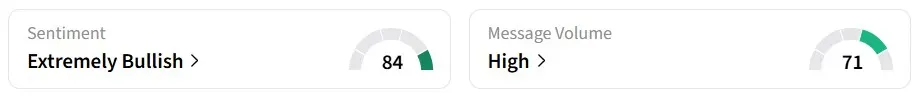

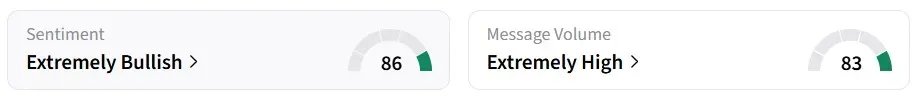

Retail sentiment for both HL and ASM on Stocktwits remained in the ‘extremely bullish’ zone over the past 24 hours.

Year-to-date, HL shares have gained around 62%, while ASM has risen 46%.

Read also: AG, ASM, HL Stocks Soar Pre-Market As Silver Blasts Past $110

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bmnr_OG_jpg_83d4f3cc27.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_jpg_753ef9f5af.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capitol_market_OG_jpg_8111684a8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222519332_jpg_15709268a8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_Power_jpg_08143c7fa0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)