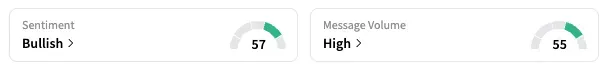

Advertisement|Remove ads.

Home Depot's SRS Distribution To Buy Home-Building Materials Company GMS For $5.5B: Retail Mood Bullish

Home Depot (HD) said on Monday that its unit SRS Distribution is buying home-building materials company GMS Inc. (GMS) for $5.5 billion in cash, including debt.

The acquisition, subject to approvals, will beef up Home Depot's offerings to professional contractors. "The combination of GMS and SRS will provide the residential and commercial Pro customer with more fulfillment and service options than ever before," SRS CEO Dan Tinker said.

They will have a combined footprint across the U.S. and Canada of more than 1,200 locations and a fleet of more than 8,000 trucks, according to a statement from Home Depot.

The deal comes as GMS was facing a hostile takeover bid from rival QXO (QXO) for $5 billion. Home Depot outbid QXO's $95.20-per-share offer for GMS with its $110-per-share bid. The accepted bid values GMS at $4.3 billion.

GMS shares soared 12% on Monday. Home Depot shares slipped 0.6%, while QXO stock gained 4%.

The deal is the latest consolidation in the home improvement space. Lowe's (LOW) acquired Artisan Design for $1.33 billion in April, while QXO in March bought Beacon Roofing Supply for $11 billion.

Home Depot acquired SRS for over $18 billion last year.

On Stocktwits, the retail sentiment for Home Depot shifted to ‘bullish’ from 'neutral' the previous day.

A user said they "absolutely love the deal."

"Feel that Home Depot got a very good price. Deal is immediately accretive, geographically significant and strategically brilliant for their Pro outfit-- think $BLDR but with more scale and leverage."

Home Depot shares are down 5.8% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228080229_jpg_dba4a8dbc2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_arthur_hayes_OG_jpg_734ff95af6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247874160_jpg_4fb51355e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)