Advertisement|Remove ads.

Honest Company Stock Rises After Q4 Revenue Tops Estimates: Retail’s Extremely Bullish

Shares of the Honest Company (HNST) rose nearly 2% on Wednesday after the personal care products company posted a fourth-quarter revenue beat, helped by strong performance across its baby apparel and wipes segment, lifting retail sentiment.

Its Q4 loss per share came in at $0.01, in line with analyst estimates, according to Stocktwits data. Q4 revenue came in at $99.84 million, up 11% year-over-year.

In Q4, the company swung to a net loss of less than $1 million compared to a net income of $1 million in the same period last year. Its net loss for 2024 narrowed to $6 million compared to net loss of $39 million in the same period the previous year.

For fiscal 2025, the company expects revenue growth to increase by 4% to 6%. It expects adjusted earnings before interest, taxes, depreciation, and amortization or EBITDA between $27 million and $30 million, the company said.

“Our Q4 and full year 2024 financial results demonstrate that our strategy, which focuses on the disciplined execution of our transformation pillars of brand maximization, margin enhancement and operating discipline, is working,” said Honest Company’s CEO Carla Vernón.

Vernón added in 2024, it saw revenue growth of 10% and its first full year positive adjusted EBITDA as a public company.

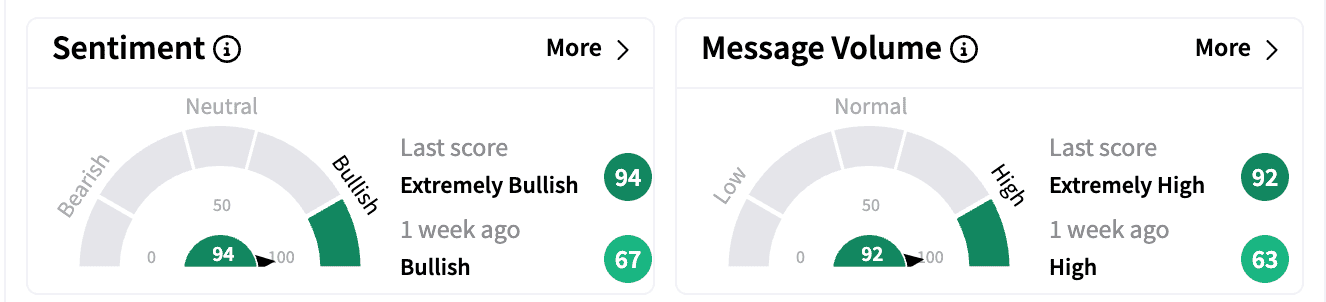

Sentiment on Stocktwits turned ‘extremely bullish’ compared to ‘bullish’ a week ago. Message volume jumped to ‘ extremely high’ territory from ‘high.’

Honest stock is up 11.61% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)