Advertisement|Remove ads.

Honeywell Stock Flirts With ‘Death Cross’ Zone — Retail Traders Remain Bearish

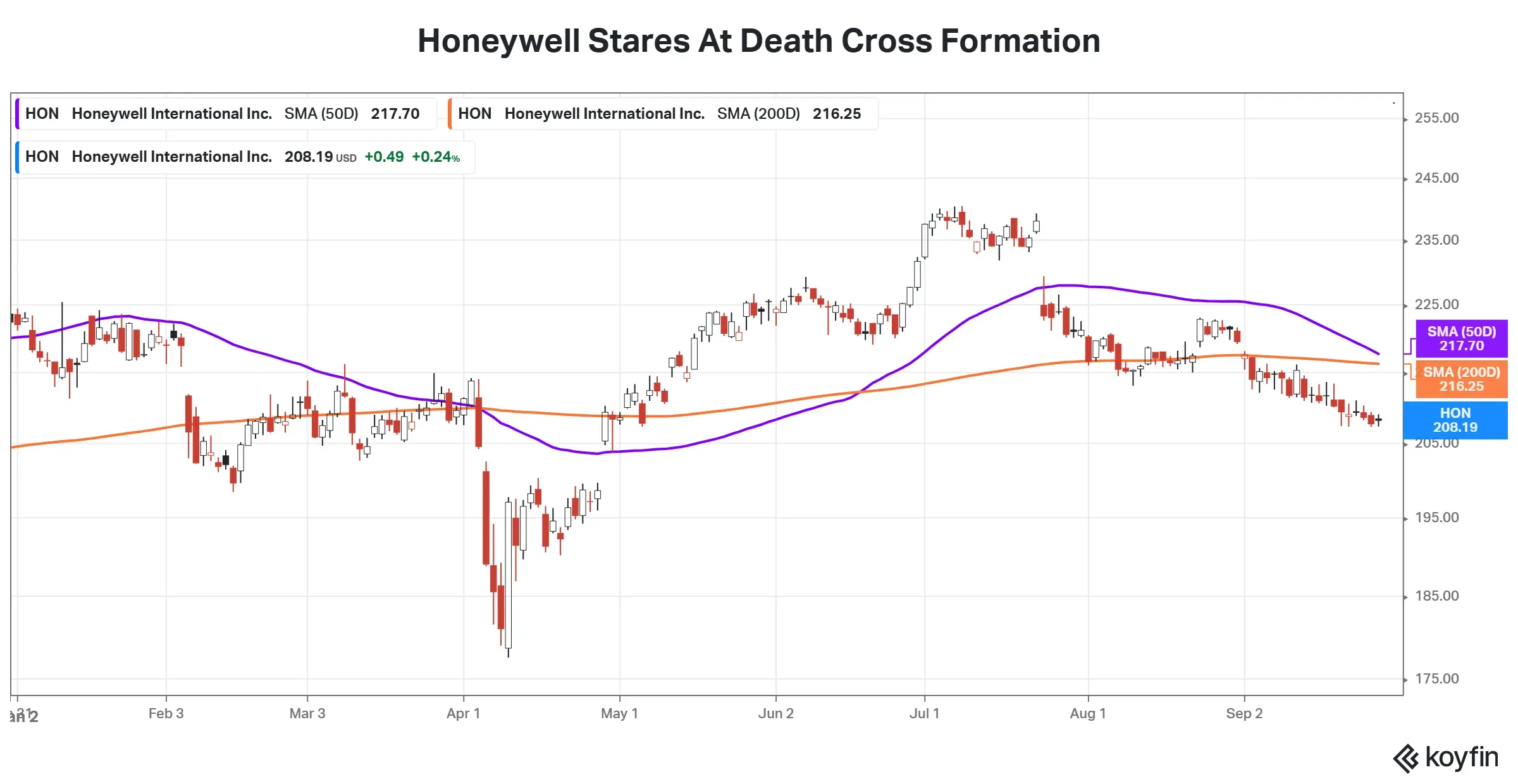

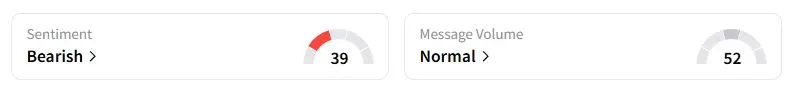

Honeywell (HON) may grab attention on Monday as the industrial giant’s stock neared the worrying “death cross” pattern, a key technical signal that indicates that further pain may be on the cards, amid sticky bearishness among retail traders.

The “death cross” is a technical indicator that forms when a stock’s 50-day moving average falls below its 200-day moving average, which could drive negative sentiment surrounding the shares. According to Koyfin data, Honeywell’s 50-day moving average stood at $217.70, perilously close to its 200-day moving average of $216.25, as of Friday’s close.

Over nearly a century, the death cross pattern in the broader markets has frequently appeared before severe bear markets, including those in 1929, 1938, 1974, and 2008. However, just the formation of this technical indicator does not always lead to further declines.

Retail sentiment on Stocktwits for Honeywell stock, which has declined 5.5% this month, was ‘bearish’ at the time of writing, with the mood unchanged from a day, week, and month ago.

The recent weakness in Honeywell shares comes despite the company raising its annual adjusted earnings and revenue forecasts in July, following strong sales in its top revenue-generating aerospace division amid a spike in global demand in commercial aviation.

Honeywell, which is also in the process of a three-way split by the second half of 2026, has raised its revenue forecast to between $40.8 billion and $41.3 billion, up from the previously projected range of $39.6 billion to $40.5 billion. However, the company’s margins continue to remain pressured by the wide swathe of tariffs imposed by the Trump administration.

“This has to be one of the most painful stocks to watch,” one user wrote, adding that it's as though it's just waiting on “news.”

Honeywell is scheduled to post its third-quarter results on Oct. 23, where analysts expect the company to report $2.57 per share in earnings and $10.14 billion in revenue. The stock has fallen 8.3% this year, compared with the S&P 500 SPDR ETF Trust’s 12.3% decline.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_moonlake_jpg_376bc698df.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_QR_OG_jpg_08610d948a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1230125578_jpg_85f30da0d4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1233729079_jpg_0ced7540cc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2204154647_jpg_b295df5f6b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Norwegian_Cruise_jpg_ba826c7555.webp)