Advertisement|Remove ads.

How Merck Is Preparing For The Patent Cliff Of Its Blockbuster Cancer Drug Keytruda

- Merck posted a modest Q4 earnings beat with adjusted EPS of $2.04 on $16.4 billion in revenue.

- The company is planning around a 2028 Keytruda patent cliff and expressed confidence in defending additional patents into 2029.

- The company cited about $70 billion in potential commercial opportunities by the mid-2030s.

Merck & Co. reported a modest fourth-quarter (Q4) earnings beat and is increasingly pointing investors toward new launches and pipeline depth as it prepares for the eventual patent cliff facing its blockbuster cancer drug, Keytruda.

The stock rose for a fourth straight session on Tuesday, gaining more than 2%, and added another 0.2% in after-hours trading.

MRK Q4 Results

Merck reported fourth-quarter adjusted earnings per share (EPS) of $2.04, slightly above expectations of $2.01, while revenue rose 5% year over year to $16.4 billion, beating consensus estimates of $16.21 billion.

Last month, the company declared a quarterly dividend of $0.85 per share for the second quarter of 2026, payable on April 7 to shareholders of record as of March 16.

Looking ahead, the company guided fiscal 2026 revenue of $65.5 billion to $67 billion and adjusted EPS of $5 to $5.15, below consensus estimates of $5.63.The outlook reflects a one-time charge of about $3.65 per share related to the acquisition of Cidara Therapeutics, which the company said will weigh on near-term results but strengthens its longer-term growth profile.

Scotiabank raised its price target on Merck to $136 from $120 following its results and reiterated an ‘Outperform’ rating, implying a 17% upside from its last close.

Merck Plans For 2028 Keytruda Patent Cliff

On its earnings call, Merck reiterated that it continues to plan around a 2028 loss of exclusivity for Keytruda’s core compound patent, even as it expressed growing confidence in defending additional method-of-use and manufacturing patents that extend into 2029. The company said it is intentionally modeling the earlier date as a prudent baseline while preparing for multiple outcomes.

Merck is also leaning on the rollout of Keytruda QLEX, a new formulation to transition patients ahead of biosimilar competition, targeting roughly 30%-40% adoption by 2028 through pricing and conversion from the intravenous version. Beyond that, the company is increasingly framing Keytruda as one part of a broader transition rather than the sole growth engine.

That message was echoed by CEO Robert Davis in a recent interview on CNBC’s Mad Money, where he said Merck’s transformation is now underway, with new launches beginning to contribute meaningfully. Davis said the company sees about $70 billion in commercial opportunities by the mid-2030s and described the current pipeline as one of the “deepest and broadest” Merck has ever had. He added that Merck is not simply competing in monoclonal antibodies; it aims to expand the market.

Merck Builds Visibility Beyond Keytruda

Merck highlighted late-stage assets across oncology, cardiometabolic and respiratory diseases, infectious diseases, and vaccines, alongside recent acquisitions of Verona Pharma and Cidara Therapeutics. The company said many of these programs are expected to be substantially de-risked over the next two years, providing clearer visibility into its revenue prospects as Keytruda’s exclusivity fades.

How Did Stocktwits Users React?

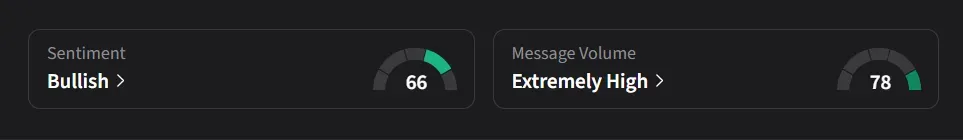

On Stocktwits, retail sentiment for Merck was ‘bullish’ amid ‘extremely high’ message volume.

One user said, “Overall impressive guidance. With dividend this is a good long-term holding.”

Another user said Merck could consider ImmunityBio’s Anktiva as part of a strategy to offset its upcoming patent cliff.

Merck’s stock has risen 20% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_ethereum_blue_original_jpg_b6e7cc57f6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_microstrategy_michael_saylor_resized_9fd19e69ec.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262651778_jpg_54075aa1d9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_ibm_signage_mwc_resized_28f91e1a63.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_stablecoins_original_jpg_b238d12be8.webp)