Advertisement|Remove ads.

HUDCO raises FY26 loan book target, focuses on urban infra push

HUDCO’s Chairman and Managing Director, Sanjay Kulshrestha, confirmed that the company is on track to achieve a 3.3% net interest margin (NIM) this year. For FY26, HUDCO aims to disburse about ₹50,000 crore, compared to ₹40,000 crore last year.

State-owned Housing and Urban Development Corporation (HUDCO) has raised it loan book target to ₹1.6 lakh crore by FY26 from ₹1.5 lakh crore earlier, driven by strong demand in the urban infrastructure segment and a steady financial performance in the first half of the year.

Chairman and Managing Director Sanjay Kulshrestha said, “We had signed lot of MoUs, you may have seen that around ₹9-8 lakh crores of the MoUs are signed. There is a tailwind. And we have now launched the Urban Invest Window (UiWIN) also, which will become a platform for all urban investments.”

The long-term AUM target of ₹3 lakh crore by FY30 remains unchanged, but given the pace of project execution, it may be achieved earlier, he added.

The UiWIN platform will facilitate faster and more diversified investments in urban infrastructure from multiple sources

HUDCO is also on track to achieve a net interest margin (NIM) of 3.3% by the end of the current financial year, backed by strong business potential in urban infrastructure and expected income from the resolution of stressed assets, said Kulshrestha.

In the July–September quarter of FY26 (Q2FY26), HUDCO reported a net interest income (NII) of ₹1,006 crore and a profit after tax of ₹710 crore.

For FY26, the company aims to disburse about ₹50,000 crore, compared to ₹40,000 crore last year.

The company is seeing significant opportunities in Greenfield projects, which offer better spreads compared to refinancing. The road infrastructure sector remains a key focus area, along with other segments such as ports, airports, energy, power, and real estate.

HUDCO has also started lending selectively to private sector projects, ensuring they are well-structured and backed by strong entities.

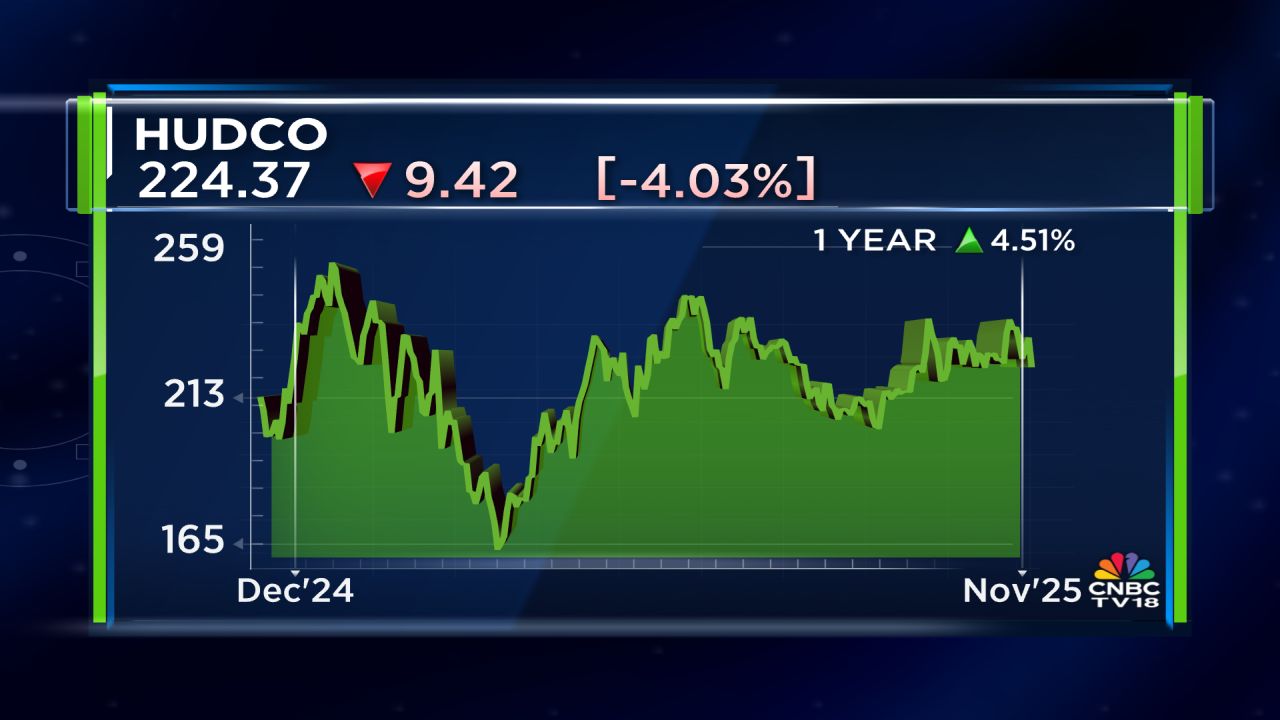

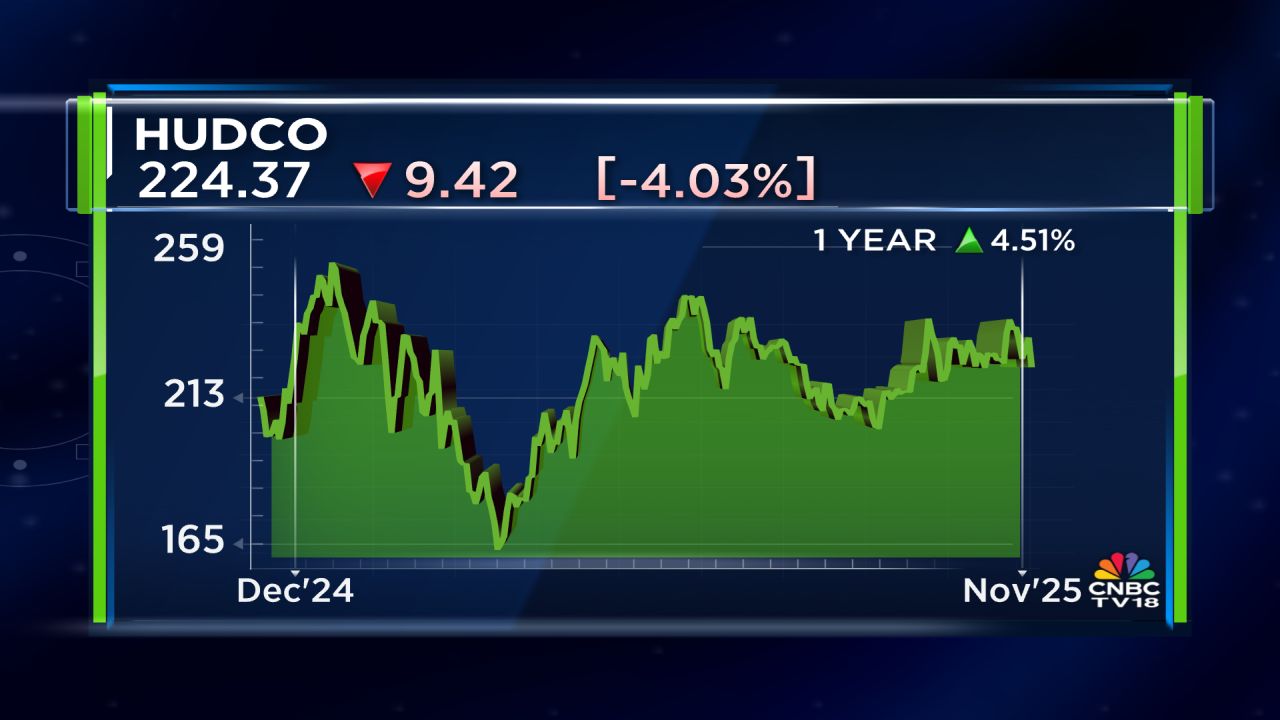

HUDCO's current market capitalisation is ₹44,762 crore. The stock is currently trading at ₹223.60 as of 10:36 am on the NSE and has gained 4% over the last year.

For full interview, watch accompanying video

Follow our live blog for more updates on Q2 results

Chairman and Managing Director Sanjay Kulshrestha said, “We had signed lot of MoUs, you may have seen that around ₹9-8 lakh crores of the MoUs are signed. There is a tailwind. And we have now launched the Urban Invest Window (UiWIN) also, which will become a platform for all urban investments.”

The long-term AUM target of ₹3 lakh crore by FY30 remains unchanged, but given the pace of project execution, it may be achieved earlier, he added.

The UiWIN platform will facilitate faster and more diversified investments in urban infrastructure from multiple sources

HUDCO is also on track to achieve a net interest margin (NIM) of 3.3% by the end of the current financial year, backed by strong business potential in urban infrastructure and expected income from the resolution of stressed assets, said Kulshrestha.

In the July–September quarter of FY26 (Q2FY26), HUDCO reported a net interest income (NII) of ₹1,006 crore and a profit after tax of ₹710 crore.

For FY26, the company aims to disburse about ₹50,000 crore, compared to ₹40,000 crore last year.

The company is seeing significant opportunities in Greenfield projects, which offer better spreads compared to refinancing. The road infrastructure sector remains a key focus area, along with other segments such as ports, airports, energy, power, and real estate.

HUDCO has also started lending selectively to private sector projects, ensuring they are well-structured and backed by strong entities.

HUDCO's current market capitalisation is ₹44,762 crore. The stock is currently trading at ₹223.60 as of 10:36 am on the NSE and has gained 4% over the last year.

For full interview, watch accompanying video

Follow our live blog for more updates on Q2 results

Read about our editorial guidelines and ethics policy

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_tesla_cybertruck_resized_7ce9ec6562.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_unh_stock_resized_jpg_e69fd915e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trading_Floor_jpg_2236744a51.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/shanthi_v2_compressed_98c13b83cf.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242189230_jpg_75730c4df7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2210426173_jpg_c803f58095.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cisco_resized_jpg_45d27290ac.webp)