Advertisement|Remove ads.

HUDCO Shares Signal Fresh Strength: SEBI RA Orchid Research Sees Long-Term Upside Of 20%

Housing and Urban Development Corporation (HUDCO) is drawing renewed interest from investors after its March-quarter (Q4FY25) results and upbeat future outlook.

The ‘Navratna’ PSU targets a 25% increase in its loan book and plans to keep bad loans at zero, further boosting sentiment.

SEBI-registered advisor Orchid Research observes that HUDCO is exhibiting signs of a reversal on the daily charts, with the Ichimoku Cloud indicator suggesting the development of fresh strength in the stock.

Recently, the company reported a 26% increase in net interest income and a 4% rise in net profit year-on-year; however, the profit growth was slightly below market expectations, leading to a 4% decline in early trade, which they view as a long-term buying opportunity

Orchid Research advises that with a recommended stop loss at ₹198, the stock could potentially rally towards ₹260 in the coming weeks, though investors should be prepared for possible volatility due to ongoing news and market sentiment.

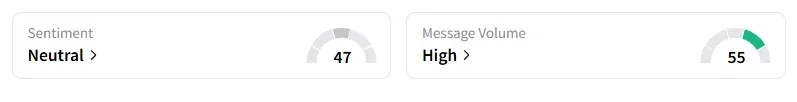

Data on Stocktwits shows retail sentiment has turned ‘neutral’ from ‘bearish’ a week ago.

HUDCO shares have fallen 8% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)