Advertisement|Remove ads.

Humana Stock Crashes, Drags Retail Sentiment To 1-Year Low On Medicare Star Rating Troubles

Humana Inc. shares ($HUM) plummeted over 20% in pre-market trading, reportedly putting the health insurer’s stock on track for its worst open since March 2020, when the COVID-19 pandemic was in its early stages.

The sharp drop came after the company revealed in an SEC filing that the government slashed the star rating of one of Humana’s largest Medicare Advantage (MA) plans, a blow that could severely impact future revenue.

According to preliminary 2025 data from the Centers for Medicare and Medicaid Services (CMS), only 25% of Humana’s Medicare Advantage members are now enrolled in plans with star ratings of 4 or higher, down from 94% in 2024.

The decline was driven by a significant drop in the rating for its H5216 plan — home to 45% of its MA membership — which fell from 4.5 stars to 3.5 stars. This plan also includes over 90% of Humana’s employer group waiver plan members.

In response, Humana expressed concerns about potential errors in CMS’s calculation methods and has filed appeals to review the results.

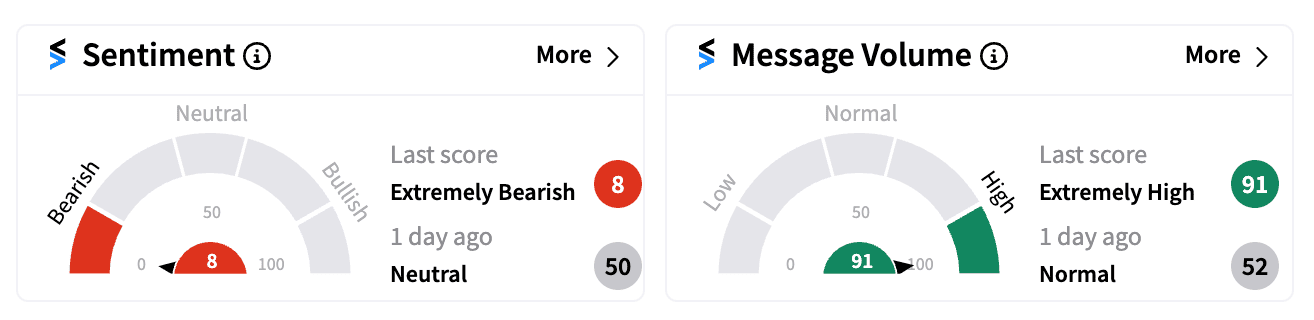

On Stocktwits, retail sentiment plunged into ‘extremely bearish’ (8/100) territory, reaching its lowest score in over a year.

Conversations among retail investors showed a growing lack of confidence, with many concerned about the long-term implications and criticizing the leadership.

Analysts also weighed in, with Barclays noting that the sell-off was likely driven by fears of 2025 ratings affecting 2026 revenue.

Wolfe Research pointed out that investors may have pieced together the 2025 star ratings using a workaround method on the CMS website, hinting at a potential 67% drop in members enrolled in 4-star plans. Wolfe still holds an Outperform rating on Humana despite this bleak outlook.

Although the company stressed that the ratings downgrade is not expected to impact its financial outlook for 2024 or 2025, Humana is facing mounting pressure.

Humana is already dealing with rising medical costs and lower government reimbursements.

If ratings on its main Medicare contract fell below the level that earns bonuses, it could reportedly result in an earnings hit of $9 per share by 2026, according to a Jefferies analyst.

With HUM stock down 39% year-to-date—compared to a 20% gain in the S&P 500—investors are keeping a close eye on whether the company can regain its footing amid mounting headwinds.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sound_Hound_jpg_7961ee756a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191702229_jpg_e9b50f268b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_LUNR_Intuitive_Machines_resized_jpg_5655032711.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_chart_falling_resized_jpg_c0ce61eff2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1903197985_jpg_2c45018acb.webp)