Advertisement|Remove ads.

Humana Stock Stirs Retail Buzz After Mixed Q4, Steeper Medicare Advantage Decline Forecast

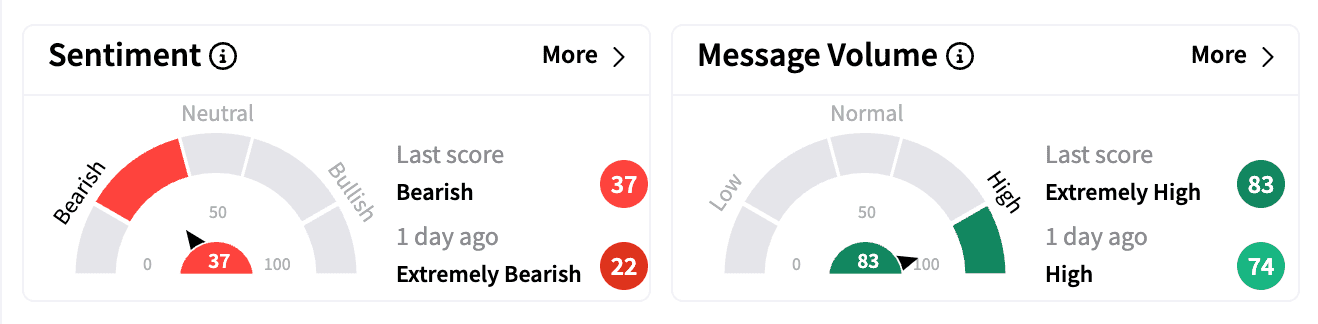

Shares of Humana Inc. were among the top 15 trending tickers on Stocktwits before the bell on Tuesday, and message volume surged after the health insurer posted its quarterly earnings.

Humana reported a fourth-quarter (Q4) adjusted loss per share of $2.16, worse than a feared loss of $2.12, while revenue came in at $29.2 billion, ahead of the $28.84 billion estimate.

The company’s benefits expense ratio climbed to 91.5% at the quarter’s end, up from 90.7% a year ago, reflecting rising medical costs.

For fiscal 2025, Humana reaffirmed its adjusted EPS guidance of approximately $16.25, below Wall Street’s expectation of $16.91.

The company also expects individual Medicare Advantage membership to decline by about 550,000, or 10%, in 2024—higher than the “few hundred thousand” drop it projected in its Q3 report.

The decline includes Humana’s exit from specific unprofitable plans and counties.

The Centers for Medicare & Medicaid Services (CMS) recently downgraded the 2025 star rating on Humana’s H5216 plan to 3.5 stars from 4.5. This plan accounts for 45% of Humana’s Medicare Advantage members, adding pressure to the company’s efforts to stabilize its business.

CEO Jim Rechtin called 2025 “a critical step in returning to compelling, normalized margins,” emphasizing Humana’s focus on Medicaid and CenterWell strategies, which are expected to drive long-term earnings growth.

Despite the earnings miss and guidance concerns, Humana shares were up 1.5% premarket Tuesday.

However, retail sentiment on Stocktwits remained ‘bearish’ as investors weighed the impact of the EPS shortfall and Medicare Advantage membership contraction.

Humana’s peers, Cigna and UnitedHealth, also recently reported mixed Q4 results, underscoring broader challenges in the managed-care sector, where rising medical costs continue to squeeze margins.

Humana’s stock has declined over 27% in the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_88435a6487.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_tilray_logo_resized_c5047aab55.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tom_Lee_BMNR_64157a5786.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tech_stocks_jpg_78bcc9c52f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)