Advertisement|Remove ads.

What’s Behind Hyperscale Data’s Surge Today?

- Hyperscale Data’s total Bitcoin treasury reached $76.1 million as of Dec.28

- The company aims to reach $100 million in Bitcoin on its balance sheet.

- Additionally, its wholly owned subsidiary, Sentinum, currently holds approximately 519.6787 Bitcoin.

Hyperscale Data Inc. (GPUS) shares gained over 2% premarket after reporting a $76.1 million Bitcoin treasury as of Dec. 28.

This figure—both direct holdings and cash for Bitcoin purchases—now accounts for roughly 117.8% of the company's market capitalization, based on its stock price at the close of trading on December 29, 2025.

$100M Bitcoin On Balance Sheet Target

The company said that after reaching its target of 100% of its market capitalization in Bitcoin, its next goal is to add $100 million in Bitcoin to its balance sheet. It said that it will fully deploy the cash allocated to its digital asset treasury (DAT) strategy into Bitcoin purchases over time.

In September, the company unveiled its $100 million BTC treasury plan, funded by selling Montana data center assets and through an at-the-market equity sale.

Subsidiary Sentinum’s Bitcoin Holdings

Sentinum, Hyperscale’s subsidiary, holds 519.6787 Bitcoin, acquired through mining and open-market purchases, worth about $45.6 million, given Bitcoin's closing price of $87,836 as of Dec. 28, 2025.

The company is setting aside $30.5 million for Sentinum to accelerate open-market Bitcoin buys.

Growing DAT Adoption

Firms globally are adopting DATs to put digital currencies on their balance sheets, as interest in the sector continues to surge.

DLA Piper reports over 200 companies adopted DATs by September 2025: 190 focused on BTC, 10–20 on other assets.

How Did Stocktwits Users React?

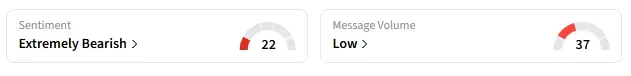

On Stocktwits, retail sentiment around Hyperscale stock trended in ‘extremely bearish’ territory amid ‘low’ message volume.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)