Advertisement|Remove ads.

This Small-Cap Biotech Stock Has Sparked A 7,000% Surge In Retail Chatter — Here’s Why

- Orphan drug status adds regulatory incentives and boosts visibility for IFx-2.0.

- Early trial data showed the treatment was safe with signs of benefit.

- The news reignited retail interest after recent analyst resets, pipeline updates, and a financing that extended the company’s development runway.

Shares of TuHURA Biosciences drew intense retail chatter on Tuesday after the company said the U.S. Food and Drug Administration (FDA) granted Orphan Drug Designation to its melanoma therapy.

FDA Orphan Drug Designation For IFx-2.0

TuHURA said the FDA’s Office of Orphan Products Development granted Orphan Drug Designation to IFx-2.0 for the treatment of stage IIB to stage IV cutaneous melanoma. The designation is based on data from a previously completed Phase 1 study, which showed IFx-2.0 was safe with no serious dose-limiting toxicities.

The study also found that some patients whose cancers had stopped responding to prior immunotherapy later responded when treated with standard immune checkpoint inhibitors.

Orphan Drug Designation provides seven years of market exclusivity upon approval, along with tax credits for certain research costs, access to FDA grants, better regulatory guidance, and a waiver of New Drug Application user fees.

TuHURA said its near-term focus remains on completing enrollment in its Phase 3 trial of IFx-2.0 in combination with Keytruda for first-line treatment of advanced or metastatic Merkel cell carcinoma.

Portfolio Updates

In December, TuHURA announced the release of contingent value rights tied to legacy Kintara Therapeutics assets after a REM-001 clinical trial in metastatic cutaneous breast cancer met its primary endpoint, demonstrating safety and signs of clinical efficacy. The milestone triggered the release of more than 1.5 million TuHURA shares to former Kintara stockholders under the CVR agreement.

Additionally, the company highlighted early research and patient-related data supporting its experimental antibody, TBS-2025, which it said showed survival benefits, particularly when used alongside standard chemotherapy or other targeted treatments.

TuHURA also said a recently completed financing, which raised $15.6 million in gross proceeds, is expected to fund key milestones across its three development programs, including IFx-2.0, TBS-2025, and earlier-stage immune-modulating platforms.

Last month, H.C. Wainwright lowered its price target on TuHURA to $10 from $12 while maintaining a ‘Buy’ rating. The brokerage said at the time that upcoming value inflection points, combined with a recent decline in the stock, created what he described as an attractive entry point for investors.

How Did Stocktwits Users React?

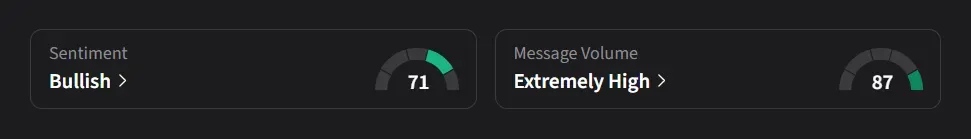

On Stocktwits, retail sentiment for TuHURA was ‘bullish’ amid a 7,300% surge in 24-hour message volume.

One user called the fall in stock price a “real loading zone.”

Another trader suggested the company’s latest capital raise could wrap up much earlier than expected.

TuHURA’s stock has declined 90% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203832195_jpg_d80f13d1c7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitdeer_OG_jpg_8f9fd0249d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)