Advertisement|Remove ads.

Hyundai Motors India Charts ₹45,000 Crore Roadmap As Tarun Garg Takes Charge As CEO

Hyundai Motor India announced two key updates in the early hours of Wednesday, sending shares up 2.8%.

Hyundai Motor India announced the appointment of Tarun Garg as its next Managing Director and CEO. The appointment will come into effect from January 1, 2026. Garg is currently the company’s whole-time director & COO. He will become the first Indian national to lead the company in its 29-year history.

Garg will succeed Unsoo Kim, who will return to a strategic role at Hyundai Motor Company in South Korea.

Garg was initially appointed as the Head of Sales, Service and Marketing at Hyundai India in 2019, before becoming the chief operating officer in 2023.

Ambitious ₹45,000 crore investment plan

Hyundai Motor India also announced an ambitious ₹45,000 crore investment plan by FY30. At its first-ever Investor Day in Mumbai, the automaker revealed plans for extensive product expansion, advanced manufacturing, and deeper localization to drive long-term growth in India.

The roadmap includes 26 new product launches, with seven new nameplates, marking Hyundai’s entry into the MPV (multi-purpose vehicle) space and off-road SUV segments. The company also plans to introduce India’s first locally manufactured dedicated electric SUV by 2027 and launch its luxury brand Genesis in the same year.

By FY30, the company aims for more than a 15% domestic market share, with utility vehicles contributing over 80% of total sales and eco-friendly powertrains exceeding 50% of the lineup. Hyundai is also targeting up to 30% exports from India by 2030.

Financially, Hyundai Motor India is targeting 1.5x revenue growth, aiming to cross the ₹1 lakh crore milestone by FY2030, while maintaining strong double-digit EBITDA margins and providing a dividend payout guidance of 20% - 40%.

It posted a revenue of ₹69,192.9 crore in the financial year 24/25.

What are technical charts showing?

SEBI-registered analyst Akhilesh Jat noted the stock had earlier corrected about 17% in 14 sessions since September 22 and is currently trading below its 20-day SMA, near the 50-day SMA, suggesting a short- to mid-term sideways tone. However, prices have taken support at a upward-sloping trendline and remain well above the 100-day SMA, reflecting a positive long-term structure.

The ₹2,360–₹2,265 zone remains a crucial support area. A breakdown here could trigger a decline to sideways movement for some period. However, as long as the price sustains above the upward-sloping trendline and the 100-day SMA, the long-term positive outlook for the stock is expected to remain intact, Jat concluded.

What is the retail mood on Stocktwits?

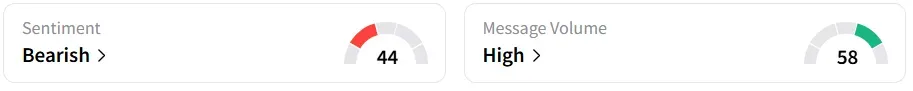

Despite Hyundai Motor India’s stock climbing higher, retail sentiment on Stocktwits turned ‘bearish’ from ‘neutral’ a session earlier, amid ‘high’ message volumes.

Year-to-date, the stock has seen strong buying interest, gaining over 35%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)