Advertisement|Remove ads.

Two Reasons Why Paytm Shares Rose Over 3% Today

Shares of One97 Communications (Paytm) gained over 3% on Wednesday, after the firm announced a major restructuring plan.

The company announced the acquisition of an additional 51.22% stake in Paytm Financial Services (PFSL) from founder Vijay Shekhar Sharma and his wholly owned entity, VSS Investco, for up to ₹0.5 crore. The acquisition will make PFSL a wholly owned subsidiary (WOS) of One97 Communications.

Following the deal, entities in which PFSL has investments, including Admirable Software, Mobiquest Mobile Technologies, Urja Money, and Fincollect Services, will also become wholly owned subsidiaries.

Subsequently, the company plans to further reorganise its structure by making these four subsidiaries wholly owned subsidiaries of One97 Communications through intra-group transactions.

Additionally, Paytm will acquire the remaining stakes in three other entities from Sharma and VSS Holdings for up to ₹3.52 crore, including Paytm Emerging Tech Limited (51%), Paytm Insuretech Private (67.55%), and Paytm Life Insurance (51%).

The company will also convert outstanding debentures and inter-corporate deposits worth around ₹15 crore in Little Internet (LIPL), increasing its stake from 62.53% to around 78%.

Axis Upgrades Stock

Axis Securities has upgraded Paytm stock to ‘Buy’ from ‘Reduce’, raising FY27-28 EBITDA projections by 33% - 46% due to strong payment margins, a scalable financial services business, and disciplined operational spending. The brokerage set a target price of ₹1,500, implying a 17.4% upside over the current price of ₹1,277.6.

What is the Retail Sentiment?

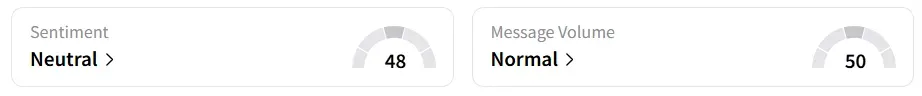

Retail sentiment on Stocktwits turned ‘neutral’ from ‘bearish’ a day earlier.

Year-to-date, the stock has gained over a fourth of its value.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)