Advertisement|Remove ads.

iBio Stock Plummets Despite Positive Data On Weight-Loss Treatment Antibody: Retail Stays Bearish

Shares of iBio, Inc.(IBIO) were in the spotlight on Monday after the company announced positive data from a study conducted in animals for its lead asset IBIO-600.

The company said data from a study on elderly and obese non-human primates shows that the anti-myostatin antibody could provide a weight loss treatment option while preserving and promoting muscle growth.

The study consisted of a single administration of two dose levels: 5mg/kg and a high dose of 50mg/kg.

Shares of the company were down by over 43% on Monday noon amid a broader market decline.

Notably, the study does not prove statistical significance and only involves a single administration of the antibody.

However, the study demonstrated an extended half-life for the antibody, potentially enabling a once three to six-month dosing schedule in humans, the company said.

CEO Martin Brenner said the company is on track for a regulatory submission for the antibody in the first quarter (Q1) of 2026.

iBio in-licensed IBIO-600 from AstralBio, Inc. in January. The company paid AstralBio $750,000 by issuing its common stock as an upfront payment and said AstralBio will also be eligible for development and commercialization milestone payments totaling up to $28 million.

On Monday, the company also announced preclinical data for an Activin E antibody and said that the antibody showed positive results in an exploratory study with obese mice, highlighting its potential as a treatment for obesity.

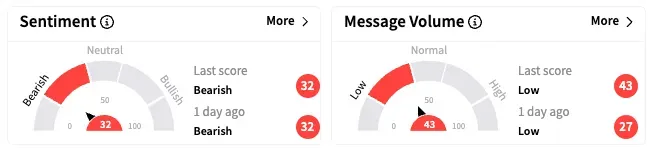

On Stocktwits, retail sentiment about iBio remained in the ‘bearish’ territory while message volume rose marginally within ‘low’ levels over the past 24 hours.

A Stocktwits user expressed surprise at the stock’s downward trajectory.

Another opined that the company needs to protect itself against any potential hostile takeovers.

iBio shares are down by over 24% this year and by over 19% over the past 12 months.

Also See: Federal Reserve Board Of Governors Will Meet Today — Traders Factor In 4 Rate Cuts This Year

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2213700945_jpg_100e788722.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262606802_1_jpg_86ff244e32.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)