Advertisement|Remove ads.

Icahn Enterprises Stock Falls After Firm Halves Dividend To Help Fund Investment In CVR Energy: But Retail Confidence Improves

Shares of Icahn Enterprises ($IEP) fell nearly 7% on Friday after the firm halved its dividend from $1.00 per depositary unit to $0.50 per depositary unit to fund its investment in CVR Energy, Inc ($CVI).

IEP currently owns 66.3% of the outstanding shares of CVR common stock. The firm proposed that Icahn Enterprises Holdings L.P. (IEH) would commence a tender offer to acquire up to 15 million additional shares of CVR Energy’s common stock for a price of $17.50 per share.

IEP believes that CVR's shares are undervalued in the market and represent an attractive investment opportunity. According to the company, CVR's shareholders are set to benefit from an opportunity to sell their shares at a premium to their trading price.

IEP said it is willing to agree with CVR Energy to certain contractual provisions for the benefit of its public stockholders following completion of the tender offer.

CVR shares jumped over 10% following the announcement.

Meanwhile, IEP also announced its third-quarter results with earnings per share (EPS) coming in at $0.05 versus an estimate of $0.21. Revenue came in at $2.8 billion compared to a Wall Street estimate of $2.7 billion.

Chairman Carl C. Icahn said he strongly believes the firm’s portfolio – both for the investment segment and the controlled businesses – has significant opportunities ahead. “Rarely have I seen a stock market with such extreme valuations – with some companies trading at unjustifiable premiums and others being massively undervalued. These undervalued situations have created great opportunities for activists,” he said.

As of Sept. 30, 2024, IEP’s indicative net asset value declined $423 million compared to June 30, 2024. This was primarily driven by positive performance in the investment funds of $192 million which was more than offset by the decline in CVI of $249 million, Automotive Services of $193 million, and the distribution to unitholders of $113 million.

The company said it has replaced senior leadership in its Automotive Services business and remains optimistic about early signs of recovery.

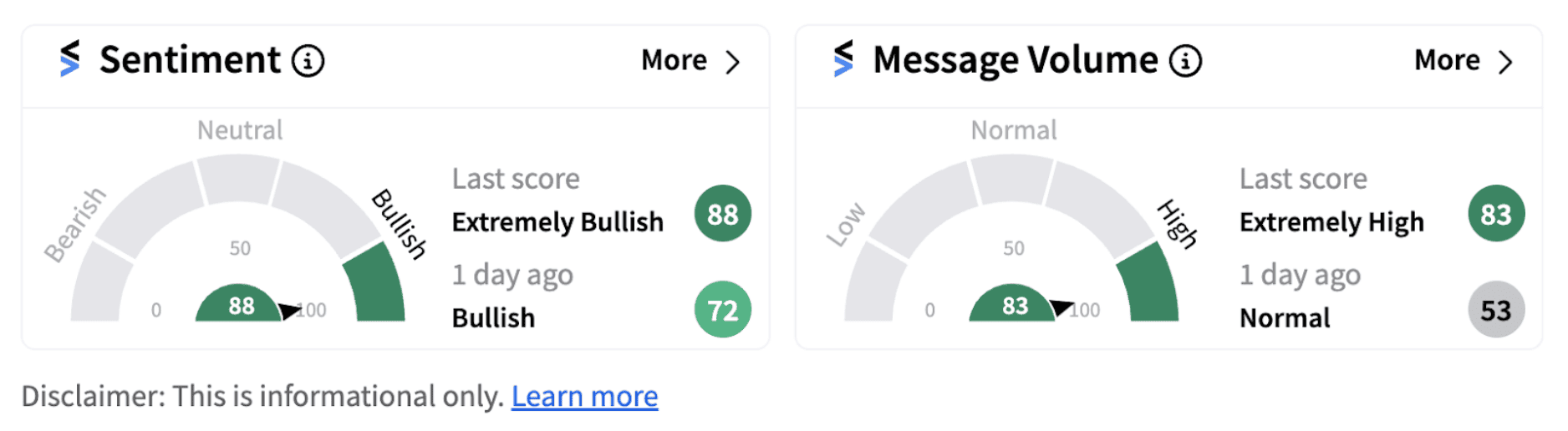

Despite the fall in stock price following the decline in dividends, retail sentiment on Stocktwits inched up into the ‘extremely bullish’ territory (88/100) from ‘bullish’ a day ago, accompanied by high retail chatter.

Meanwhile, retail users expressed confidence about the stock’s potential in coming times.

IEP shares have lost over 31% on a year-to-date basis.

Also See: Toast Stock Butters Up Retail Mood With 11% Pre-Market Jump On Q3 Profit Turnaround

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_picks_jpg_78f3fd40de.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1485519874_1_jpg_98db213058.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Soybean_jpg_f368631c0f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_samsung_jpg_fcdaaf7c72.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_cardano_markets_resized_852566e294.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)