Advertisement|Remove ads.

‘Incredible’ or ‘Absolute Bubble’? AppLovin Retail Buzz Explodes After Record Rally Brings Valuation Closer To Giants

AppLovin Corp.’s (APP) stock rallied over $42 or 6% in Monday’s regular session, hitting a fresh peak, after Wall Street analysts issued upbeat commentaries about the app marketing platform’s prospects. Retail optimism improved following the stock’s record run.

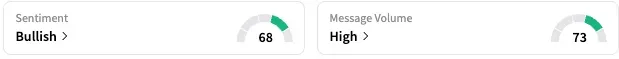

Retail chatter on the AppLovin stock stream on Stocktwits surged up 3,016% over the 24 hours leading up to late Monday. Sentiment toward the stock improved to ‘bullish’ (70/100) by late Monday from ‘neutral’ the day before.

A bullish watcher has already set their eyes on the $800 level. The stock ended Monday’s session at $712.36 after climbing as high as $745.61 intraday. Some called Monday’s rally “incredible.”

Another delved into the huge market opportunity before the company. “Could we imagine a world that every individual e-commerce seller on TikTok or QVC or Shopify would need APPLOVIN or partner with them to sell their products?” they said.

In a note published on Monday, Morgan Stanley analyst Matthew Cost raised the price target for AppLovin stock to $750 from $480, attributing the optimism to the AXON Ads Manager self-serve tool for non-gaming that the company plans to launch on Oct. 1. “This is a key catalyst to grow its ad business and prove that it can tap into billions of ad dollars outside the game industry,” the analyst said.

Cost said the self-serve option will likely help AppLovin’s customer base grow, from the 600-700 advertisers it has as clients with the manual onboarding currently in place. The launch will begin on a referral-only basis, before opening to all advertisers in the second half of 2026, with international customers also to be included for the first time, he noted.

The analyst rates AppLovin an “Outperform.” He raised his 2025 and 2026 earnings before interest, taxes and depreciation estimates for the company by 5% and 22%, respectively, factoring in a bullish outlook on the non-gaming self-service launch.

Separately, Phillip Securities initiated coverage of AppLovin with an ‘Accumulate’ rating and a $725 price target, according to a summary of the note on The Fly. The firm based its bullish thesis on AppLovin’s leadership in performance-driven mobile games advertising, its “impressive” 76% operating margin, and the likelihood of the company continuing to grow ad revenue by 55%. The firm also sees AppLovin’s core mobile game advertising business benefiting from generative artificial intelligence (GenAI)-related improvements.

Skeptical retail users, however, raised concerns about AppLovin’s valuation. “Absolute bubble,” a user said. Another noted that the company’s market capitalization is now equivalent to that of Goldman Sachs.

One retailer said they have the stock on “put watch” for Tuesday, and looked to sell into the strength.

Another comparison was made with enterprise infrastructure giant Salesforce (CRM), which boasts a market capitalization of $233.34 billion as of Monday’s close versus AppLovin’s $226.58 billion. The user noted that AppLovin, a single-purpose Adtech platform, had $3.4 billion in revenue, compared to Salesforce, which generated $37 billion in revenue, and had ten times the scale of AppLovin and a durable cash flow. “That’s like a food truck being worth more than McDonald’s because it had a few great quarters,” they said.

AppLovin shares, which came under pressure after their February peak amid the release of a few short reports and the Trump tariff market meltdown seen in early April, resumed their rally thereafter. The news of the company’s addition to the S&P 500 Index added fuel to the upward climb.

For the year-to-date period, the stock has gained nearly 120%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Why EchoStar Stock Jumped Nearly 9% After-Hours Today

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2234227546_jpg_b7fa546ca4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262656307_jpg_562c79e1bd.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256305566_jpg_26cd17b56a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_wall_street_sign_resized_f75f6c0a63.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2255969940_jpg_0903b745a1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_LUNR_Intuitive_resized_cab4ddef01.jpg)