Advertisement|Remove ads.

India Market Wrap: Nifty Ends Below 24,400 Dragged By Pharma, PSU Bank Stocks

Indian benchmark indices ended near the day’s low on Tuesday as investor sentiment soured amid renewed U.S. tariff concerns and persistent geopolitical unease along the India-Pakistan border.

The Ministry of Home Affairs has instructed all states to conduct mock drills on Wednesday in response to "new and complex threats."

The Nifty 50 ended below 24,400, while the Sensex closed at 80,641. The broader markets underperformed, too, with the Nifty Midcap index tumbling 2%.

Sectoral weakness was widespread, with all major indices except auto ending in the red.

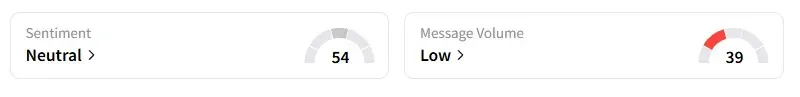

On Stocktwits, retail sentiment surrounding the Nifty 50 has turned ‘neutral’ as traders grew cautious ahead of key global and domestic events.

Pharma stocks fell sharply, led by Aurobindo Pharma and Cipla (both down nearly 3%), after U.S. President Donald Trump signed an executive order promoting local drug manufacturing. This move is seen as hurting Indian exporters.

Yes Bank shares recouped losses to close 1.4% higher after the lender denied media reports about a potential stake sale to Sumitomo Mitsui Banking Corp (SMBC), stating the reports as "factually incorrect.”

Bank of Baroda shares plunged 10% after posting weak quarterly numbers, triggering a sharp sell-off in PSU banking names.

CCL Products surged 16% on robust Q4 earnings, emerging as the day's top gainer.

Polycab India climbed 2%, driven by strong earnings and a healthy dividend payout, defying broader market weakness.

M&M ended 1% higher, supported by brokerage upgrades.

Indian Hotels dropped 6% despite posting a decent quarterly performance.

Paytm (-5%) and HPCL (-3%) declined ahead of their earnings announcements later in the day.

And electric two-wheeler maker Ather Energy ended 6% lower after a tepid listing.

Global risk appetite remained subdued ahead of a critical U.S. Federal Reserve policy decision this week. European markets traded lower, and Dow futures pointed to a weak Wall Street open, signaling continued caution in global equities.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2177851484_jpg_b969f68c05.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2158238458_jpg_48ab7af27c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rocketlab_resized_jpg_92c1a02a7f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)