Advertisement|Remove ads.

India Markets End Higher Amid Late Rally; Railway and Defense Stocks Shine

Indian equity benchmarks ended higher after markets witnessed a surge in the last hour of trade as investors eyed a potential breakthrough on tariffs amidst the ongoing development in U.S.-China trade talks.

The Sensex ended 260 points higher to close at 80,998, while the Nifty 50 rose 77 points to finish at 24,620.

The broader markets outperformed, with the Nifty Midcap and Smallcap indexes gaining 0.7%.

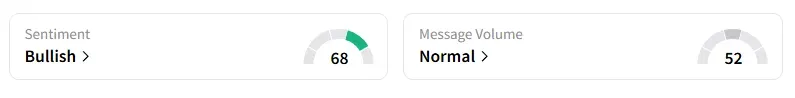

Retail investor sentiment surrounding the Nifty 50 remained ‘bullish.’

On the sectoral front, all indices ended in the green except real estate.

Eternal emerged as the top Nifty gainer, closing 3% higher. Swiggy hit a two-month high after Morgan Stanley initiated coverage with an ‘Overweight’ rating and a target price of ₹405, implying an 11% upside.

Railway and defense stocks saw strong buying action. IRCON jumped 14% on winning a ₹1,068 crore EPC order from East Central Railway, while RailTel surged 12% after selecting Techno Electric to partner on a data centre project in Uttar Pradesh.

In the defense pack, GRSE rallied 7% after signing a memorandum of understanding (MoU) to build India’s first polar research vessel, while BEL gained 3% on fresh order wins worth ₹537 crore.

Sun Pharma Advanced Research (SPARC) plunged 20% after its psoriasis drug failed Phase 2 trials.

Aditya Birla Fashion Retail tumbled 10% following a ₹583 crore block deal by Flipkart, which offloaded a 6% stake. Indegene also slid 4% on block deal activity.

Bharti Airtel rose 2% after Macquarie hiked its target price to ₹2,050, with a bull-case estimate of ₹2,350.

Reliance Infrastructure shares spiked 11% after a favorable ruling from the National Company Law Appellate Tribunal (NCLAT), which overturned an earlier insolvency order issued by the National Company Law Tribunal (NCLT).

From a technical perspective, SEBI-registered analyst Krishna Pathak observed that Nifty shows signs of consolidation just below the 24,615 resistance zone. The index has closely respected the 9-period exponential moving average (EMA), suggesting indecision and a potential breakout set-up.

He believes a clear resistance lies at 24,615, above which a move toward the resistance zone of 24,735 to 24,800 could be expected. On the downside, the support zone between 24,510 and 24,500 remains crucial, and a breakdown below this may trigger further selling pressure.

European markets traded higher as the U.S. exempted Britain from additional metal tariffs, and Dow Futures indicated a positive opening for Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219301415_jpg_7634ca599c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2236469013_jpg_0a72164947.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2244672917_jpg_95b721e1af.webp)