Advertisement|Remove ads.

India's Nifty, Sensex Jump On Trump's Temporary Tariff Relief: Retail Cautiously Optimistic

It was a sea of green across Dalal Street on Tuesday. Indian markets rallied strongly, with the benchmark Nifty and Sensex surging over 2%, tracking strong global cues on the back of U.S. President Donald Trump's tariff reprieve.

India's volatility index (VIX) also dropped sharply, by 19% to 16.6.

Last week, Trump announced a 90-day pause on certain tariffs that eased investor concerns about escalating trade tensions and sparked optimism across global markets.

His decision on Monday to delay additional tariffs on imported vehicles and parts boosted Indian stocks following a market holiday at the start of the week.

Auto, banking, financial services, realty, and metals led the charge on Tuesday.

Mid-cap and smallcap stocks joined the rally, with the Nifty Midcap 100 and Nifty Smallcap 100 indices rising 2% and 2.5%, respectively.

Indian auto stocks, such as Tata Motors, Samvardhana Motherson, and Sona BLW, saw substantial gains.

Tata Motors rose as much as 5%. Its Jaguar Land Rover brand has significant exposure to the U.S. market.

Additionally, Trump extended tariff relief over the weekend for the electronics sector, with temporary exclusions on certain consumer electronics.

Indian tech companies, such as Dixon Technologies and Kaynes Technology, saw a 5% and 8% rise in trade today.

Financial stocks also contributed to the rally, with HDFC Bank's 3.5% increase following its decision to reduce savings account interest rates, which eased margin concerns for the bank.

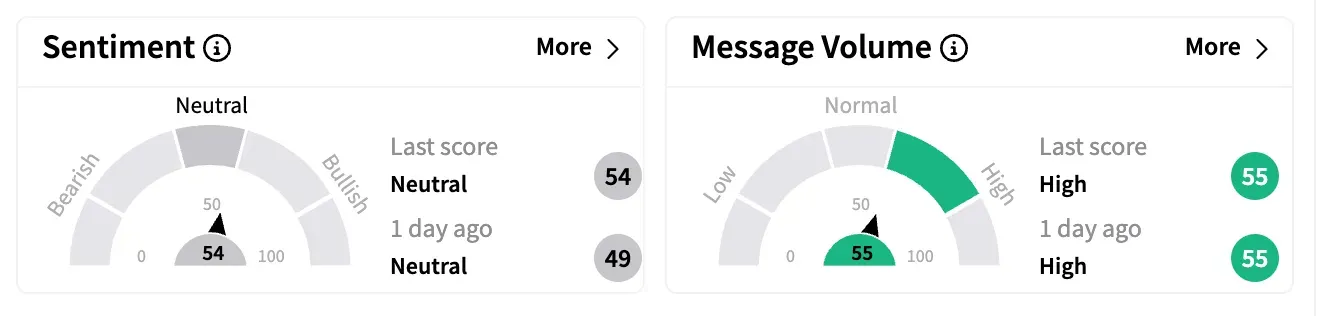

On Stocktwits, sentiment for the Nifty 50 stayed 'neutral,' although the score climbed higher from a day earlier, indicating cautious optimism from retail investors over future trade negotiations.

One bullish user believes there will only be higher bottoms from now and suggested the market had entered a "Buy on Dip Mode."

However, a bearish user warned that the Nifty closing below 22,081 could take it as low as 20,642 to 19,344.

Bloomberg reported that India started trade talks with the U.S. on Monday, with both sides aiming for clarity on concessions by the end of May.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_jeff_merkley_jpg_aca807f10f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230437216_jpg_6078a75ee4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2149037439_jpg_ab9f73d5f7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2205870374_jpg_15fedc8d2f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_berkshire_hathaway_jpg_86250c27d6.webp)