Advertisement|Remove ads.

Indian Stocks Edge Up In Early Trading As Nifty, Sensex Hold Key Levels: Retail Traders Stay Cautious

India's stock markets opened marginally higher on Tuesday amid broadly weak global cues.

The benchmark indices held above key levels, with the Nifty up about 0.2% at 24,178 and the Sensex rising by the same level to 79,606 by 9:50 am IST.

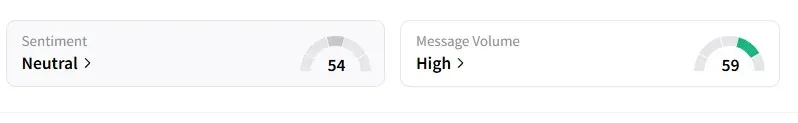

Data from Stocktwits showed that sentiment around the Nifty 50 stayed 'neutral,' indicating that retail investors are cautious as they continue to parse commentary on the U.S. Federal Reserve and President Donald Trump's trade war.

Globally, Asian markets were mixed, while U.S. equity futures rose after a steep sell-off on Monday.

Barring the tech sector, the rest of the sectoral indices gained in early trade, led by FMCG, real estate, and consumer durables stocks.

Bank stocks like HDFC Bank and Kotak Mahindra Bank gained more ground. The Reserve Bank of India (RBI) adjusted its liquidity coverage ratio (LCR) norms, giving banks more flexibility in managing their funds. This move aims to encourage banks to increase lending and improve liquidity.

Steel stocks like SAIL, Tata Steel, and JSW Steel gained over 1% after the government imposed a 12% provisional safeguard duty on certain steel products for 200 days, excluding developing countries other than China and Vietnam.

Waaree Energies' stock rose over 3% following a U.S. decision to impose anti-dumping duties on solar equipment imported from four Southeast Asian countries: Cambodia, Vietnam, Malaysia and Thailand. These new duties are in addition to the tariffs levied by Trump earlier this month.

The Mumbai-based solar panel maker is set to report fourth-quarter earnings later on Tuesday.

Real estate developer Anant Raj clocked gains of 4% following strong earnings that showed a 52% rise in profit to ₹118.6 crore.

Also on the earnings radar, investors will monitor HCL Technologies, Mahindra & Mahindra Financial Services, Havells India, AU Small Finance Bank, and Tata Communications as they report quarterly numbers later in the day.

SEBI-registered research analyst Ashish Kyal said on Stocktwits that the Nifty 50 had reached the upper Bollinger Bands on the daily timeframe. Based on recent average prices, the upper Bollinger Band is a line on stock charts showing when prices might be too high and could drop soon.

Kyal added that this marks the sharpest upward movement without significant pullbacks. He suggests a breach below 23,880 could trigger profit booking, but until then, the uptrend remains intact.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)