Advertisement|Remove ads.

India's Sensex, Nifty Rise In Early Trading As Bank Stocks Lead The Charge

Indian markets opened Monday on a higher note despite mixed global cues.

At 9:35 am IST, the benchmark Nifty was up 0.6% at 23,997, while the Sensex gained nearly 0.4% to 78,885. The midcap and smallcap indices were showing positive moves. But all eyes were on the banks and financials that led the bullish charge on Dalal Street.

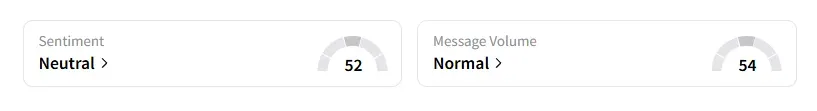

Data from Stocktwits showed that sentiment around the Nifty 50 stayed 'Neutral’, although the score had edged up from a day ago.

Globally, Asian markets were mixed, while U.S. equity futures, too, trended lower as tariff headwinds continued to weigh on investor sentiment.

There were strong gains across the board in banks, financials, and IT stocks. The Nifty Bank index hit a record high, crossing 55,000. It has gained 10% in the last month.

The Nifty IT index rose over 1.5% with gains across large-cap tech stocks.

HDFC Bank gained nearly 2% after the country's largest private lender reported a 6.7% rise in its profit to ₹17,616 crore. Steady asset quality, improvement in margins, and growth in deposits aid investor sentiment.

ICICI Bank's stock was up 1% on solid earnings. Margins and asset quality remain steady. The private lender's net profit rose by 18% to ₹12,630 crore for the quarter ended March on the back of healthy treasury gains and a rise in fee income.

Infosys stock gained 1% despite earnings missing street estimates. India's second-largest IT company has also revised its guidance lower for the year ahead. For FY26, Infosys expects revenue to grow between 0% and 3% in constant currency terms.

Investors will monitor Tata Investments, Himadri Specialty Chemicals, Anant Raj, and Aditya Birla Money as they report earnings later on Monday.

SEBI-registered research analyst Bharat Sharma said on Stocktwits that the Nifty 50 will trade between 22,000 and 24,000 in the absence of any strong triggers.

Bharat sees immediate support at 23,800. If breached, he expects the index to hit 23,700, 23,570, and 23,450. He pegged immediate resistance at 23,870, and if breached, he sees a target at 24,000 - 24,050 on the upside.

Bharat emphasized monitoring the 24,000 breakout level for signs of a rally. If it breaks, we can expect to test 24,800, he added.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Dimon_July_b5bbf1a09d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_rare_earth_july_d867df7d47.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1710397990_jpg_c2ac3394d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2244297865_jpg_34f8b38611.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_stablecoins_original_jpg_b238d12be8.webp)