Advertisement|Remove ads.

Indian Markets Rally To Nine-Month High: Nifty Reclaims 25,500, Bank Nifty Hits Record High

Indian equity markets surged to a nine-month high on Thursday, led by strong buying in financials, metals, oil & gas stocks. The Nifty reclaimed 25,500 in the expiry session. A weakening dollar, easing geopolitical tensions in the Middle East, and lower crude oil prices boosted investor sentiment.

The Sensex surged 1,000 points to close at 83,755, while the Nifty 50 rose 304 points to finish at 25,549.

The Bank Nifty hit a fresh record, surging past 57,000, led by gains in HDFC Bank, Axis Bank, ICICI Bank, and AU Small Finance Bank. The broader markets underperformed, with the Nifty Midcap and Smallcap indices gaining 0.5%.

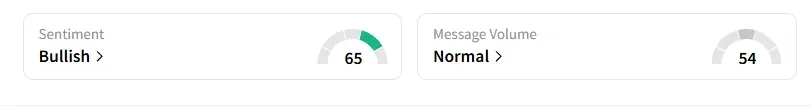

The retail investor sentiment surrounding the Nifty 50 remained ‘bullish’ on Stocktwits.

Sectorally, barring IT, media and real estate stocks, rest of the indices ended in the green. Four Nifty stocks, including Bharti Airtel and Grasim tested fresh record levels today.

Cement stocks rallied: Dalmia Bharat gained 5%, Shree Cements rose 4%, Ambuja Cements, ACC and Ultratech ended 2% higher.

Oil marketing companies, such as IOC, HPCL and BPCL, ended 3% higher as crude oil prices stabilized.

Mobikwik shares witnessed a stellar rebound, ending 7% higher after a large block deal.

Lloyds Metals rose 2% after the company received environmental clearance from the Ministry of Environment to expand its iron ore mining capacity to 55 million tonnes per annum.

Globally, European markets traded higher, and Dow Futures indicated a weak opening for Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2200882557_jpg_53f3e467bc.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Seagate_jpg_50a56724b4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262656307_jpg_562c79e1bd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202349941_jpg_3f45878d03.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_540185275_jpg_21d1350875.webp)