Advertisement|Remove ads.

Indian Markets Shake Off Tariff Shock, Nifty Climbs Back Above 24,800; SEBI Analyst Flags TCS For Technical Bounce

Indian equity markets have staged a sharp recovery in afternoon trade on Thursday, shrugging off concerns after U.S. President imposed 25% tariffs on India overnight, along with an unspecified additional penalty related to India’s acquisition of Russian oil and military supplies.

Investor sentiment improved after President Trump stated that trade negotiations with India would continue. Indian officials have indicated that the next round of negotiations is scheduled for early August.

The Nifty index recovered close to 200 points to trade above 24,800, while the Sensex recovered over 600 points by noon, led by gains in FMCG and private banks. On the flip side, pharma, real estate, and energy stocks continued to trade under pressure.

The broader markets continue to be under pressure, with the Nifty Midcap and Smallcap indices trading 0.5% lower.

Hindustan Unilever (HUL) was the top Nifty gainer, rising over 3% on the back of steady June quarter earnings. Followed by Jio Financial, which rose 3% after its board approved fundraising via preferential issue.

SEBI-registered analyst Sunil Kotak noted that the Nifty index respected its Relative Strength Index (RSI) at 40, and that despite the tariff shock, Indian markets are holding for now. He identified support at 24,550, with resistance at 24,950.

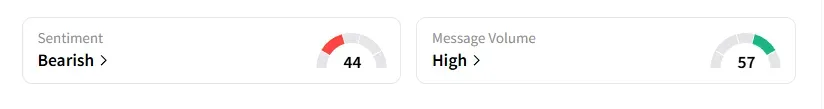

However, data on Stocktwits shows that retail sentiment has slipped to ‘bearish’ from ‘neutral’ earlier in the day amid ‘high’ message volumes.

Stock Recommendation

Analyst Dhruv Tuli has flagged a technical setup in TCS. He noted that after a breakdown from the rising trendline, the stock has now reached a major support zone around ₹3,000–₹2,900, its first retest in a long time.

Additionally, an RSI below 30 on the weekly chart signals oversold conditions, increasing the probability of a technical bounce from here. He recommends adding TCS to the watchlist as the price action near this level could offer a low-risk opportunity.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2222341271_jpg_26b9066cf6.webp)