Advertisement|Remove ads.

IndusInd Bank Shares Jump After External Audit Shows Smaller-Than-Expected Hit From Derivatives Lapses: Retail Mood Brightens

IndusInd Bank shares rallied nearly 6% on Wednesday as investors shrugged off recent concerns about discrepancies in the bank's derivative portfolio.

In a post-market filing on Tuesday, the private lender disclosed that an external audit identified a ₹1,979 crore negative impact on its net worth as of June 30, 2024, due to irregularities in its derivative dealings.

That translates to a 2.27% post-tax reduction in net worth projected by December 2024, slightly better than the bank's prior internal estimate of 2.35%.

The smaller-than-expected impact has likely reassured investors and contributed to Wednesday's positive trading sentiment.

IndusInd Bank stated it will reflect these impacts in the FY 2024-25 financial statements and is committed to strengthening internal controls over derivative accounting.

These remarks also seem to have bolstered confidence among retail investors.

International brokerages maintained their rating on the stock and saw limited impact from the discrepancies. Macquarie retained its target at ₹1,210, while Morgan Stanley maintained it at ₹775.

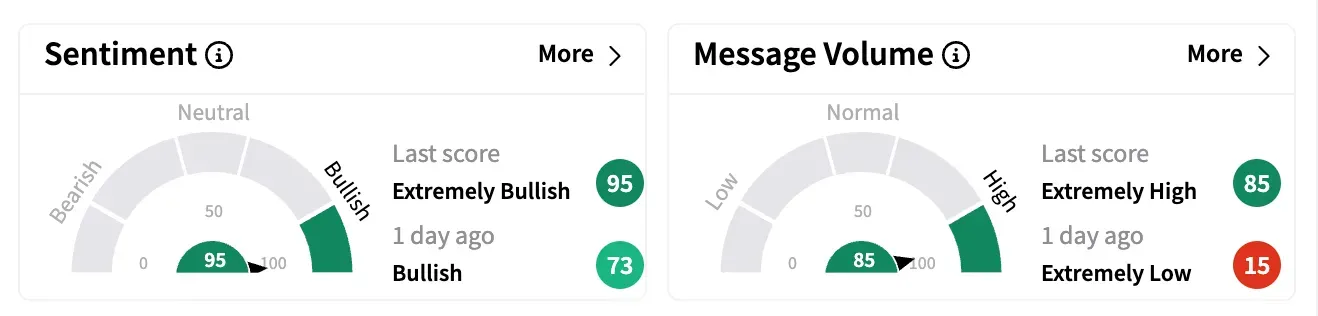

Data from Stocktwits indicates retail sentiment turned 'extremely bullish' despite a 42% fall over the past six months.

One user believes it could be the start of a recovery and is watching it closely for signs of sustained strength.

However, SEBI-registered research analyst Harika Enjamuri said on Stocktwits that while short-term momentum could lift the stock, fundamental risks tied to governance, asset quality mix, and a weakening deposit profile continue to weigh on sentiment.

"The market is unlikely to re-rate the stock until there's clear visibility on new leadership, internal control upgrades, and a technical breakout above ₹893," she added.

IndusInd Bank is down 19.2% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_jeff_merkley_jpg_aca807f10f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230437216_jpg_6078a75ee4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2149037439_jpg_ab9f73d5f7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2205870374_jpg_15fedc8d2f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_berkshire_hathaway_jpg_86250c27d6.webp)