Advertisement|Remove ads.

EXCLUSIVE: Quantum Stocks Are Still Hot — And Infleqtion's CEO Sees Industry Consolidation, $160B Opportunity As It Heads For SPAC Listing

- Matt Kinsella said that computing is not the only product coming from quantum technologies.

- There's a wide range of other products, including quantum sensors, quantum clocks, RF antennas, gravimeters, and different types of inertial sensing equipment.

- Citing McKinsey’s research, the executive said Infleqtion’s total addressable market (TAM) is about $160 billion.

Quantum computing company Infleqtion is set to go public via a Special Purpose Acquisition Company (SPAC) deal with Churchill Capital Corp. (CCCX), a blank-check company founded by ex-Citi executive Michael Klein. The ongoing government shutdown may have pushed back the going-public timeline slightly. Still, it hasn’t dampened Infleqtion CEO Matt Kinsella's optimism about what the future holds out for the company.

Since the SPAC deal was announced, Churchill Capital stock has gained about 60%.

Stockwits sat down with Kinsella, a former venture capitalist and a breakthrough technology evangelist, for a freewheeling chat about Inflqeqtion and its way forward:

Here are excerpts from the interview:

Quantum Tech Is Much More Than Computing

Kinsella attributed the skepticism toward the quantum computing industry to the pushed-out timelines. “For the last 20 years, it's always kind of been, oh, in five years we'll have quantum computing. It's always been this kind of rolling five years, and when you get there, it's five years from now we'll have it, and then five years from now you'll have it,” he said.

The skepticism, according to the executive, stems from a bucket of misconceptions — that computing is the only product emerging from quantum technologies. “There's a whole umbrella of other types of products, such as quantum sensors, where quantum is already developing products that are truly orders of magnitude better than classical standards.” He also mentioned products such as quantum clocks, RF antennas, gravimeters, and other types of inertial sensing equipment.

Quantum Space In An Excited State

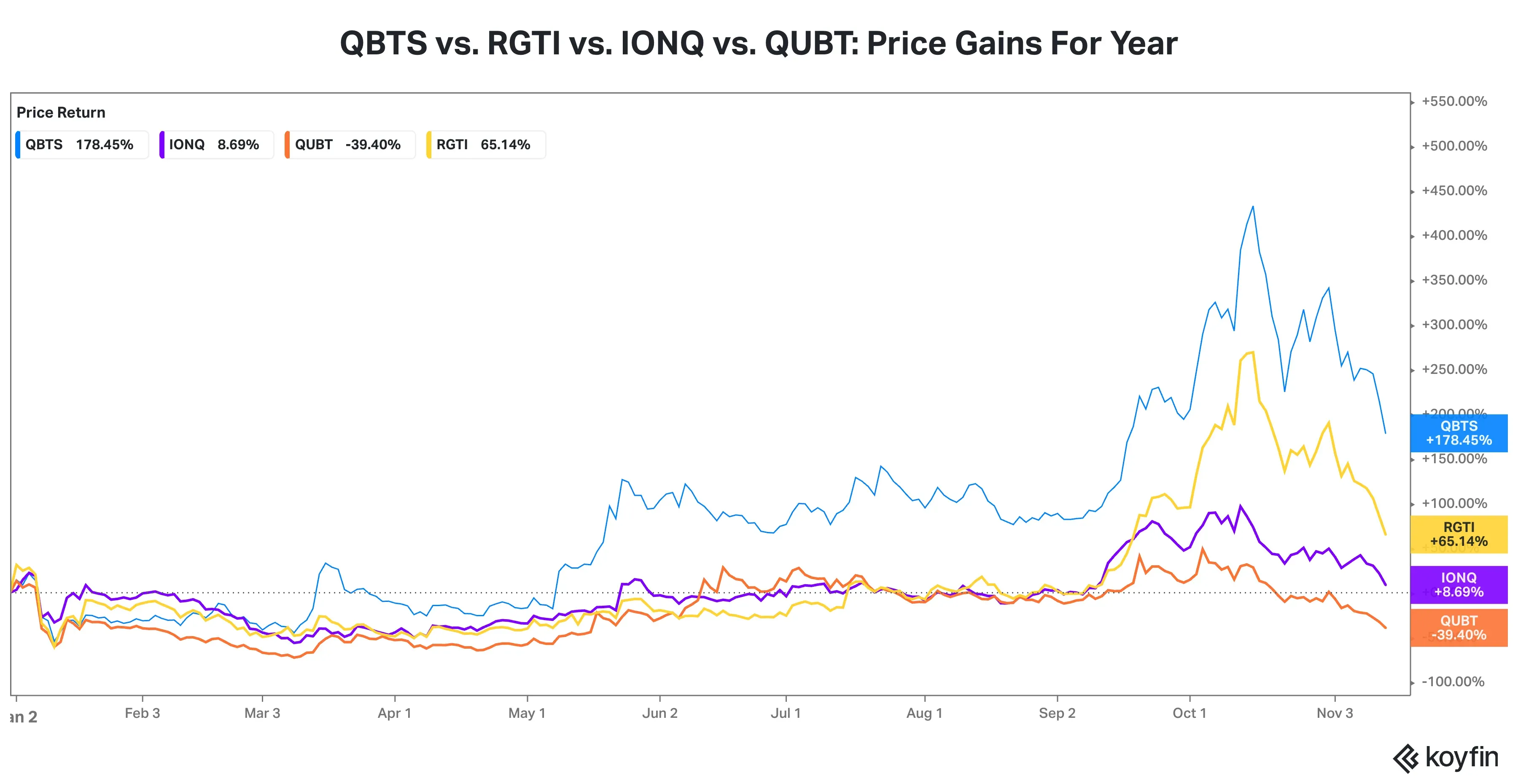

Quantum computing stocks began the year on a slow note as they digested the torrid gains made in 2024, most of which occurred late in the year. These stocks also moved in tandem with the broader market when it declined sharply in early April, following President Donald Trump's announcement of punitive tariffs.

Rumors that the Trump administration was eyeing stakes in quantum companies provided a solid boost to these stocks in October. D-Wave Quantum is among the best-performing publicly listed quantum companies this year, with gains exceeding 175%.

Source: Koyfin

Citron Research touted in early October that Infleqtion is a far better quantum play than Rigetti.

Big Tech companies have also made significant inroads in quantum computing, with Alphabet announcing its Willow quantum chip late last year. Last month, it unveiled a breakthrough quantum algorithm, dubbed “Quantum Echoes,” which CEO Sundar Pichai claims is 13,000 times faster than the best classical algorithm on one of the world's fastest supercomputers. That earned adulation even from Tesla CEO Elon Musk, who replied, “Looks like quantum computing is becoming relevant.”

On Wednesday, IBM unveiled IBM Quantum Nighthawk, its most advanced quantum processor yet. As the industry makes slow and steady progress toward large-scale commercial adoption, Infleqtion finds itself in the sweet spot, positioning itself as a provider of a broad array of quantum products.

The Qubit Conundrum

Kinsella said another misconception is a lack of understanding of the concept of logical qubits. A qubit is the basic unit of information in quantum computing, analogous to a bit in classical computing.

He said Infleqtion holds the record for commercial qubits at 1600. “These are physical qubits, but what really matters in quantum computing are logical qubits. And logical qubits are error-corrected physical qubits.”

“And it's generally thought that at 100 logical qubits, we will start to be able to do things with quantum computers that classical computers can't do.”

Kinsella conceded that in terms of quantum computing, “we are not yet there.” While companies have different roadmaps for their logical qubits, Infleqtion plans to have 100 logical qubits by 2028. “So I think that's a reasonable line in the sand to say we'll start to do things that are commercially useful with quantum computers.”

Trump’s Quantum Thrust

To a question about the Trump administration’s rumored interest in taking stakes in quantum computing companies, just as it invested in rare earth companies, Kinsella said such a move is possible. “I think it's the mentality of this administration to have taxpayers benefit from work that the government does with various deep tech companies.”

Kinsella said the U.S. government is Infleqtion’s biggest customer and the company is constantly in talks with the government. “The topic of equity is brought up from time to time, and so I think, you know, we will continue to do a lot of business with the U.S. government, and those conversations will play out as they play out.”

China Competition

It’s a race with China, just like it is in other areas. Kinsella said China is investing significantly more dollars in quantum than the U.S. has historically, but the U.S., along with its allies, invests more than China does. “But importantly, I think the U.S. is doing what it does often, and that's relying on its private capital markets to fund the innovation.”

Biggest Customer

Kinsella said government accounts for more than 50% of Infleqtion’s revenue, with the Department of Defense (DoD) and government-run energy grids included in this category. The company also sells its clocks to non-governmental customers and academic institutions.

Citing McKinsey’s research, the executive stated that Infleqtion’s total addressable market (TAM) is approximately $160 billion, comprising $30 billion in quantum sensing revenue and $130 billion in quantum computing revenue.

Consolidation In the Offing?

While hinting that quantum computing is not a zero-sum game, Kinsella sees some degree of consolidation. “I think you'll probably end up with a handful of very large, very important quantum companies over the course of the next five to 10 years.”

“One of the reasons why Infleqtion is going public is because I think we will be one of those consolidators, and we'll be one of those important companies. I think we have a head start now and an advantage, and we want to compound that advantage going forward.”

Government Shutdown Throws A Wrench

Kinsella said Infleqtion was shooting for the end-of-the-year listing timeframe. “I hadn't really factored in the government shutdown into my calculations, and so I think it'll probably be in Q1, assuming the government gets reopened. Is it January or March? I don't know at this point.” The executive noted that the company has filed the S4 report confidentially with the SEC.

Message For Retail Investors

“I personally believe quantum is going to be a very important technological shift for humanity over the course of the next decade. And I think it's great that the retail investing community is going to have more options to be able to participate in that over time,” Kinsella said, urging retail investors to do their due diligence. “But I think it's great that there will be the opportunity to invest in, you know, now another quantum company like Infleqtion.”

“If you want to have exposure to the broad spectrum of opportunities that quantum can provide across both sensing and computing, Infleqtion is a very good way to represent that broader quantum bet.”

Infleqtion will be the only publicly traded neutral-atom quantum, he said. That means it’s a company that develops quantum computers using neutral atoms, which lack an electrical charge. These companies use lasers to trap and manipulate these neutral atoms, arranging them into precise configurations to act as qubits for complex calculations.

Kinsella thinks “neutral atoms are going to be the ones that win in quantum computing and therefore, we would be the way to express that.”

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203832195_jpg_d80f13d1c7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261740483_jpg_28cc9c7ce9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)