Advertisement|Remove ads.

Info Edge Shares: SEBI RA Mayank Singh Chandel Flags ₹1,525 As Key Level For Rally

Info Edge (Naukri) posted solid fourth-quarter earnings, and its chart is showing signs of strength, according to SEBI-registered analyst Mayank Singh Chandel.

He believes the stock is gearing up for a potential breakout, as it trades below a crucial resistance level.

At the time of writing this copy, Info Edge shares traded 3% lower on Wednesday.

Info Edge reported a net profit of ₹463.3 crore, up 667% from ₹60.3 crore year-on-year. Revenues too rose 14% to ₹749.6 crore.

This impressive growth was driven by a rebound in recruitment billing and continued momentum in non-recruitment verticals, which remain cash-positive.

From a technical perspective, Chandel highlights that the stock found strong support near ₹1,311-₹1,244 before breaking above a falling trendline, indicating a bullish reversal in play.

Info Edge is currently consolidating just below ₹1,525, with evident accumulation.

Chandel believes that a breakout above ₹1,525 could trigger fresh momentum, making it a potential breakout candidate.

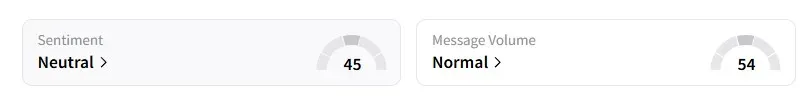

Meanwhile, on Stocktwits, retail sentiment remained ‘neutral’ amid ‘normal’ message volume.

Info Edge shares have fallen 80% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)