Advertisement|Remove ads.

Why Infosys Shares Are Surging: 4 Key Triggers Behind The Rally

- Infosys promoters will not participate in ₹18,000 crore share buyback

- Reports suggest tariffs on Indian goods could be reduced to 15% - 16%

- US clarifies that the $100,000 H-1B fee applies only to new petitions filed from outside the US by individuals without a valid H-1B visa

Shares of Indian IT bellwether Infosys surged nearly 5% to ₹1,543.9 on Thursday following a series of positive triggers. These range from promoters opting out of the record ₹18,000 crore buyback to upbeat Q2 earnings and renewed optimism over a U.S.-India trade deal.

Promoters Won’t Participate In Share Buyback

On October 22, Infosys announced that its promoters, including Nandan Nilekani and Sudha Murty, will not participate in the company’s ₹18,000 crore share buyback program. The IT giant plans to repurchase up to 10 crore shares at ₹1,800 per share, a 22% premium over Wednesday’s closing price, making it the company’s largest-ever buyback

Infosys stated that since promoters have opted out, their equity holdings will be excluded from the entitlement ratio calculation. As of the September quarter, the promoter group collectively held a 14.3% stake in the company.

The decision by promoters to abstain from the buyback is often seen as a vote of confidence in the company’s long-term growth prospects. It may also enhance the retail entitlement ratio once the process begins.

Trade Deal On The Horizon?

India and the United States are reportedly on the cusp of finalizing a long-overdue trade agreement. The deal could significantly lower U.S. tariffs on Indian goods from around 50% to around 15% to 16%, according to a report by Mint.

U.S. President Donald Trump said he spoke with Prime Minister Narendra Modi on Tuesday, focusing mainly on trade and energy.

H1-B Visa Fee Clarification

In what could be a huge relief for the Indian IT industry, the United States Citizenship and Immigration Services (USCIS) clarified that the recently introduced $100,000 fee applies only to new petitions filed from outside the U.S. by individuals without a valid H-1B visa.

Crucially, those already inside the country on valid visas are exempt from this fee. This eases financial uncertainty for tech workers in transition and allows employers to proceed with change-of-status filings without the hefty surcharge.

Q2 Results See Improvement

Infosys reported a consolidated net profit of ₹7,364 crore in Q2FY26, marking a 13.2% year-on-year rise, supported by steady growth in large deal wins. Revenue climbed 8.6% YoY to ₹44,490 crore, while operating margin stood at 21%.

In constant currency terms, revenue grew 2.9%. The company also declared an interim dividend of ₹23 per share. Infosys expects FY26 revenue growth of 2% - 3% in constant currency with an operating margin range of 20% – 22%.

What Is The Retail Mood On Stocktwits?

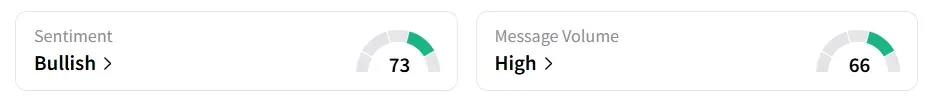

Despite the stock’s uptick, sentiment on Stocktwits shifted to ‘bullish’ from ‘extremely bullish’ a session earlier, amid ‘high’ retail chatter.

Infosys shares were also the biggest gainers on the Nifty 50 index on Thursday.

Year-to-date, the stock has shed 18.4%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_cybertruck_jpg_7f6ed70b80.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Workday_logo_resized_d2d5258f05.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Lucid_jpg_221b9d07ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222819201_jpg_edcbb1336e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)