Advertisement|Remove ads.

INMD Stock Draws Investor Attention On Q4 Financial Update

- The firm is scheduled to report its financial performance for Q4 and fiscal 2025 ahead of the market open on Tuesday, Feb. 10, 2026.

- The company’s total revenue for fiscal 2025 is projected around $370.2 million to $370.4 million.

- Looking ahead, the company has set a revenue forecast for fiscal 2026 between $365 million and $375 million.

InMode (INMD) stock is gaining investor attention in Friday’s premarket after the medical technology provider announced its fourth quarter (Q4) sales outlook.

The company said it anticipated its fourth-quarter (Q4) sales to fall within a tight range of $103.6 million to $103.8 million, compared with the analyst consensus estimate of $104.64 million, according to FiscalAI data.

2025 And 2026 Outlook

The firm is scheduled to report its financial performance for Q4 and fiscal 2025 ahead of the market open on Tuesday, Feb. 10, 2026. The company’s total revenue for fiscal 2025 is projected to be around $370.2 million to $370.4 million, below the analysts' consensus estimate of $371 million, as per FiscalAI data.

InMode expects a non-GAAP gross margin near the high end of the 70% range for the full 2025 fiscal year. Looking ahead, the company has set a revenue forecast for fiscal 2026 between approximately $365 million and $375 million. InMode stock inched 0.8% higher in Friday’s premarket.

What Are Stocktwits Users Saying?

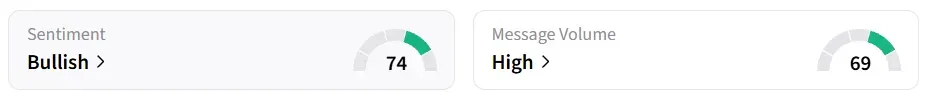

On Stocktwits, retail sentiment around the stock remained in ‘bullish’ territory while message volume shifted to ‘high’ from ‘normal’ levels in 24 hours.

A bullish Stocktwits user highlighted sequential growth and high margins.

Another user pointed to ongoing pressure in the aesthetic device sector, noting that demand remains subdued, but added that the latest outlook broadly aligns with the company’s earlier outlook for 2025, suggesting performance is tracking as expected.

Brokerage Radar

In December, Canaccord cut its price target on InMode to $15 from $16 and kept a ‘Hold’ rating on the stock, according to TheFly. The firm said it still has a positive long-term view on the medical technology industry going into 2026, noting that mid-sized company valuations remain low, and deal activity is increasing.

INMD stock has declined by over 10% in the last 12 months.

Also See: Trump Says Big Oil Will Invest At Least $100 Billion To Rebuild Venezuela's Oil Infrastructure

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260447662_jpg_cd246b74f6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2254924116_jpg_d54ffea07e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228900989_jpg_e94daec744.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)