Advertisement|Remove ads.

Inovio Pharmaceuticals Q3 Earnings Tops Estimates, Lifts Retail Sentiment

Shares of Inovio Pharmaceuticals Inc. ($INO) dipped more than 10% during mid-day trading on Friday after the company’s third-quarter earnings beat analyst estimates, but retail sentiment on Stocktwits remained upbeat.

For the quarter ended September 30, Inovio posted net loss of $25.2 million, or $0.89 per basic and diluted share, compared to net loss of $33.9 million, or $1.52 per basic and diluted share in the same period last year.

For the quarter ending September 30, Inovio reported a loss of $0.89 per share, beating analyst estimates of a $1.15 loss per share, according to Stocktwits data.

Inovio’s revenue came in at $0.11 million in line with analyst estimates.

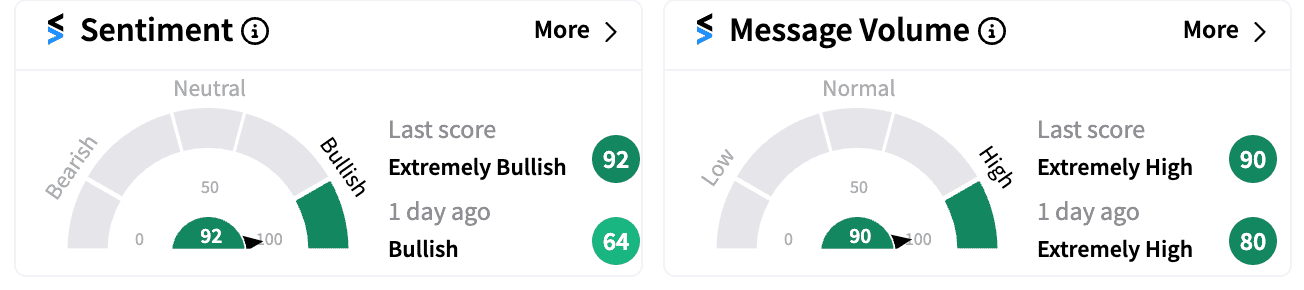

Retail sentiment on the stock improved to ‘extremely bullish’ (92/100) from ‘bullish’ (64/100) a day ago. Message volume remained at ‘extremely high’ levels.

In fresh guidance, the company said it estimates its cash runway to extend into the third quarter of 2025. This projection includes an operational net cash burn estimate of about $24 million for the fourth quarter of 2024.

Plymouth Meeting, Pa.-based company is focused on developing DNA medicines to help treat HPV-related diseases, cancer, and other infections. Its lead product candidate, INO-3107,has shown to prompt an immune response that helps reduce the need for surgery in recent trials.

“We continue to be focused on advancing INO-3107 and delivering a non-surgical option to RRP patients,” Jacqueline Shea, Inovio's President and CEO said in a statement.

According to the third-quater report, Inovio’s cash position has shrunk compared to the end of last year. As of September 30, cash and short-term investments were $84.8 million compared to $145.3 million as of December 31, 2023.

The company’s R&D expenses rose to $18.7 million compared to $15.5 million for the same period in 2023.

Meanwhile, its G&A expenses were slightly down, attributable to a decrease in employee compensation, including non-cash employee and consultant stock-based compensation, among other factors.

Many Stocktwits users were bullish:

Inovio Pharmaceuticals stock is down 36.3% year-to-date.

For updates and corrections, please email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/corescientific_ff43030093.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Royal_Caribbean_jpg_b85e38f7a0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2231279747_jpg_9150b71435.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Nvidia_jpg_90354aa51a.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/12/mobile-2024-12-b6a62138d9f7795a8368c0835ce9f4eb.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)