Advertisement|Remove ads.

Inovio Pharma Stock Slips Ahead of Q3 Earnings: Retail’s Bullish

Shares of Inovio Pharmaceuticals ($INO) slipped nearly 2% on Thursday afternoon ahead of the company’s third-quarter results, with retail sentiment staying bullish.

Wall Street analysts expect earnings per share (EPS) of around -$1.15 on revenues of $0.11 million. Inovio has missed estimates three times in the past four quarters.

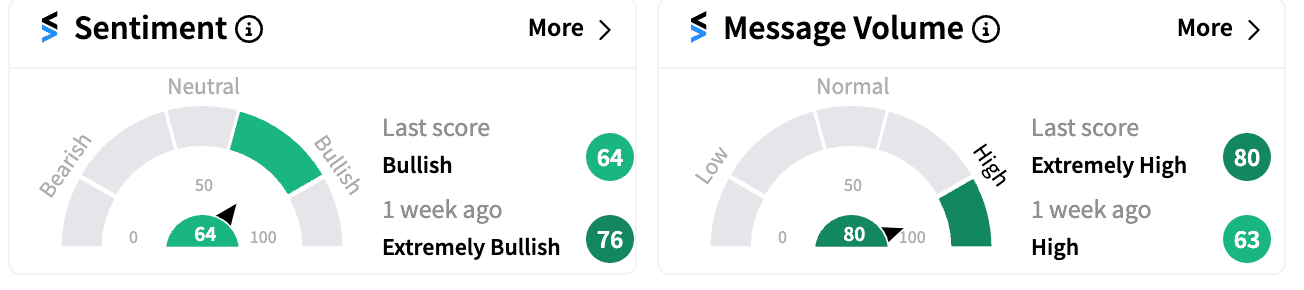

Retail sentiment on the stock dipped to ‘bullish’ from ‘extremely bullish’ last week, while message volumes rose to ‘extremely high’ territory.

Plymouth Meeting, Pa.-based Inovio is focused on developing DNA medicines to help treat HPV-related diseases, cancer, and other infections. Its lead product candidate, INO-3107, in recent trials, has shown to prompt an immune response that helps reduce the need for surgery.

"We continue to make progress with our lead candidate, INO-3107, which has the potential to significantly improve the lives of patients with RRP,” Jacqueline Shea, Inovio's President and CEO, noted at the time of its Q2 earnings.

Analysts have a consensus rating of ‘neutral’ with its average one-year price target at $7, a potential 35.92% upside, Benzinga reported.

Stocktwits users seem optimistic about the stock despite its mixed performance.

Inovio stock is down 28.43% year-to-date.

For updates and corrections, email newsroom@stocktwits.com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/corescientific_ff43030093.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Royal_Caribbean_jpg_b85e38f7a0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2231279747_jpg_9150b71435.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Nvidia_jpg_90354aa51a.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/12/mobile-2024-12-b6a62138d9f7795a8368c0835ce9f4eb.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)