Advertisement|Remove ads.

Intel Says It Has No Plans To Divest Stake In Mobileye: Retail Gives Thumbs Up

Intel Corp (INTC) said on Thursday it has no plans to divest a majority stake in Mobileye (MBLY), a firm that it acquired in 2017. The clarification comes after Bloomberg News reported in early September that the chip-maker might be considering options to offload its stake in the automated driving systems provider.

Shares of Mobileye shot up 15% on Thursday following the announcement while Intel shares rose over 3%.

Intel said in a statement that by providing Mobileye with separation and autonomy, it has enhanced its ability to capitalize on growth opportunities and accelerate its path to creating even greater value.

“We believe in the future of autonomous driving technology and in Mobileye’s unique role as a leader in the development and deployment of advanced driver assistance systems (ADAS),” the chipmaker said.

Intel currently holds close to an 88% stake in Mobileye. The firm develops self-driving technologies and advanced driver-assistance systems including cameras, computer chips, and software. Intel had acquired the firm in 2017 and had relisted it in 2022. Shares of the firm have lost over 56% this year.

Bloomberg had reported that the potential considerations are part of Intel’s massive overhaul.

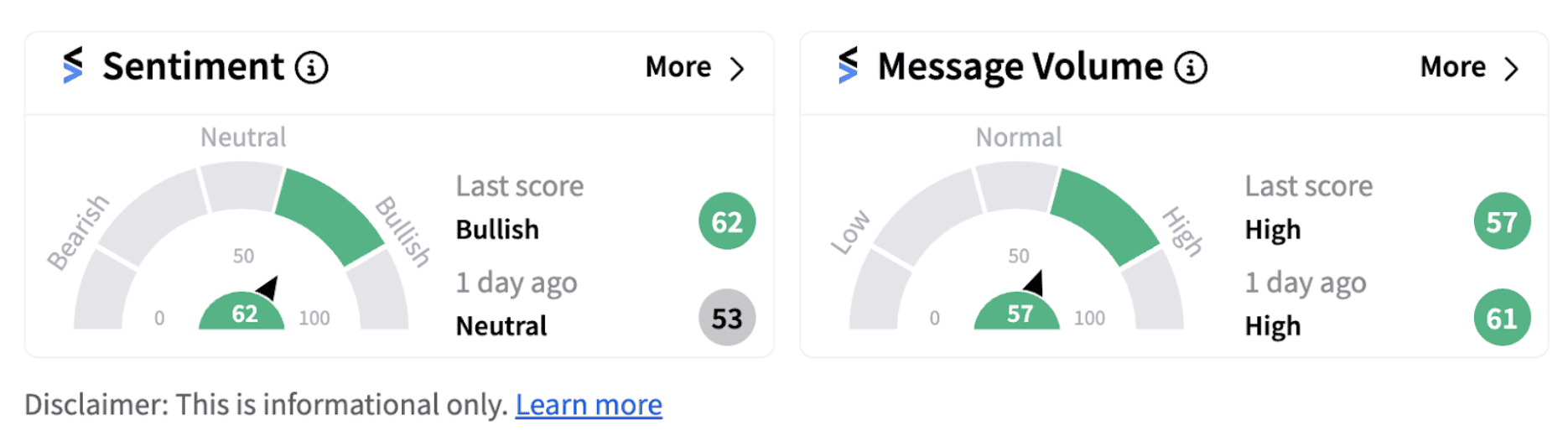

Following the announcement, Stocktwits retail sentiment for Intel shifted into the ‘bullish’ territory (62/100) from the ‘neutral’ zone.

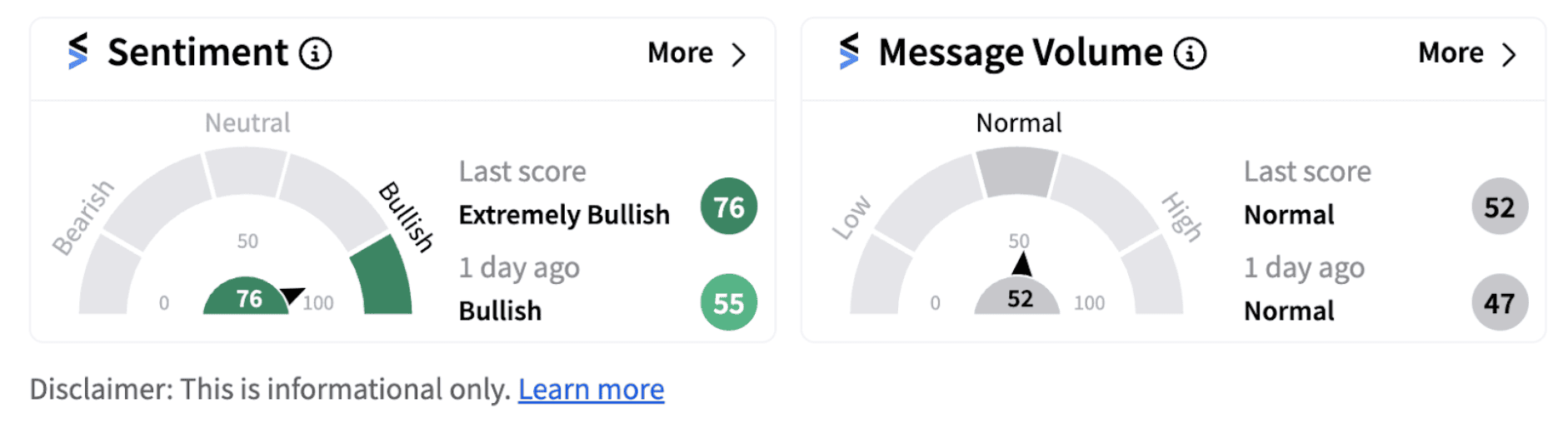

Meanwhile, the sentiment meter for Mobileye shifted into the ‘extremely bullish’ territory (76/100) from the ‘bullish’ zone.

Intel shares have risen nearly 10% in the last five days. Earlier this week, CEO Pat Gelsinger announced the firm’s plans to establish Intel Foundry as an independent subsidiary inside of the company.

Intel believes such a subsidiary structure will unlock important benefits, most importantly, providing future flexibility to evaluate independent sources of funding and optimize the capital structure of each business to maximize growth and shareholder value creation.

The structure also provides its external foundry customers and suppliers with a clearer separation and independence from the rest of Intel. The chipmaker will be establishing an operating board that includes independent directors to govern the subsidiary.

Despite the near-term rally, Intel shares are still down over 55% on a year-to-date basis. Bullish followers of the stock, however, are hopeful of a rally in the near term.

Also See: JetBlue Plans To Open Its First-ever Airport Lounges In New York, Boston: Retail Stays Positive

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2213582854_jpg_830e44a354.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943683_jpg_d01763122d.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/07/whatsapp-business-2025-07-be92a2c43157e61dd8748a769c6ab84b.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/07/tata-group-2025-07-65ccfee43b311b2001c68dd4eec5ebb4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1243243511_jpg_58a7a7cb8e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)