Advertisement|Remove ads.

JetBlue Plans To Open Its First-ever Airport Lounges In New York, Boston: Retail Stays Positive

JetBlue (JBLU) announced on Thursday it is planning its first airport lounges, marking a shift away from its low-cost operations as the airline tries to win big spending travelers as part of its JetForward strategy. Shares of the firm were trading over 1.5% higher on Thursday morning following the announcement.

The airline will be opening its first lounge at New York’s John F. Kennedy International Airport Terminal 5 in late 2025 and the second one at Boston Logan International Airport Terminal C soon after.

JetBlue’s lounge will span 8,000 total square feet at John F. Kennedy International Airport and 11,000 square feet at Boston Logan International Airport.

President Marty St. George said lounges have become an essential offering for the growing numbers of customers seeking premium experiences, and JetBlue’s lounges will further boost the value of its TrueBlue loyalty program as it expands its portfolio of JetBlue credit cards.

JetBlue said complimentary access to its lounges will be available to holders of a new premium JetBlue credit card, TrueBlue Mosaic 4 members, and Transatlantic Mint customers.

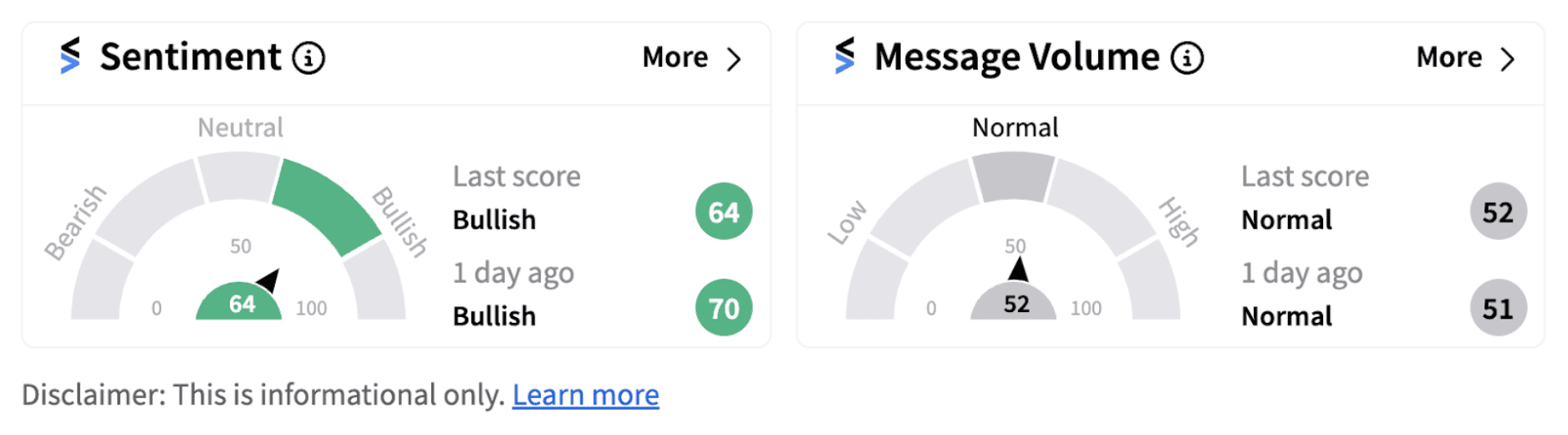

Following the announcement, retail sentiment on Stocktwits continued to trend in the ‘bullish’ territory (64/100).

Notably, Bank of America (BofA) recently doubled its price target on the stock to $6 while improving the rating to ‘Neutral’ from ‘Underperform.’

The analyst reportedly noted that as travel demand measured by TSA throughput has been stable in recent weeks and domestic capacity continues to moderate, coinciding with falling fuel prices, JetBlue's positioning will be further supported by self-help measures.

JetBlue has been in the news after the airline reported a surprise profit during the second quarter. Although it posted an 82% year-over-year (YoY) decline in its net income to $25 million, the figure beat Wall Street expectations of a loss. Moreover, the company’s announcement about deferring approximately $3 billion of capital expenditures through 2029, to improve its cash flow outlook, also found favor among investors.

The airline now expects to generate $800-$900 million of incremental earnings before interest and taxes (EBIT) from 2025 through 2027 and expects the benefit to be realized evenly over those three years.

JetBlue shares have gained nearly 10% on a year-to-date basis. The stock is likely to attract more investor confidence if it follows through with its cost savings plans in the coming times.

Also See: Darden Restaurants Stock Rises Pre-market Despite Weaker-Than-Expected Q1 Report: Retail’s Surprised

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2213582854_jpg_830e44a354.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943683_jpg_d01763122d.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/07/whatsapp-business-2025-07-be92a2c43157e61dd8748a769c6ab84b.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/07/tata-group-2025-07-65ccfee43b311b2001c68dd4eec5ebb4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1243243511_jpg_58a7a7cb8e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)