Advertisement|Remove ads.

Intel Stock Soars On Plan To Spin Off Foundry Business, Make AI Chips For Amazon Web Services: Retail Cheer Grows

Intel Corp (INTC) shares rose more than 2% early Tuesday after CEO Pat Gelsinger announced the firm’s plans to establish Intel Foundry as an independent subsidiary inside of the company.

Intel believes such a subsidiary structure will unlock important benefits, most importantly, providing future flexibility to evaluate independent sources of funding and optimize the capital structure of each business to maximize growth and shareholder value creation.

The structure also provides its external foundry customers and suppliers with a clearer separation and independence from the rest of Intel. The chipmaker will be establishing an operating board that includes independent directors to govern the subsidiary.

“A more focused and efficient Intel Foundry will further enhance collaboration with Intel Products,” Gelsinger said.

The announcement comes as a big relief to investors as the foundry business has had a significant impact on Intel’s profitability, with the firm reportedly spending about $25 billion on it in each of the last two years.

Not surprisingly, Intel’s stock has lost over 56% this year with the firm lagging behind rivals such as Nvidia and AMD, who have capitalized better on the AI boom.

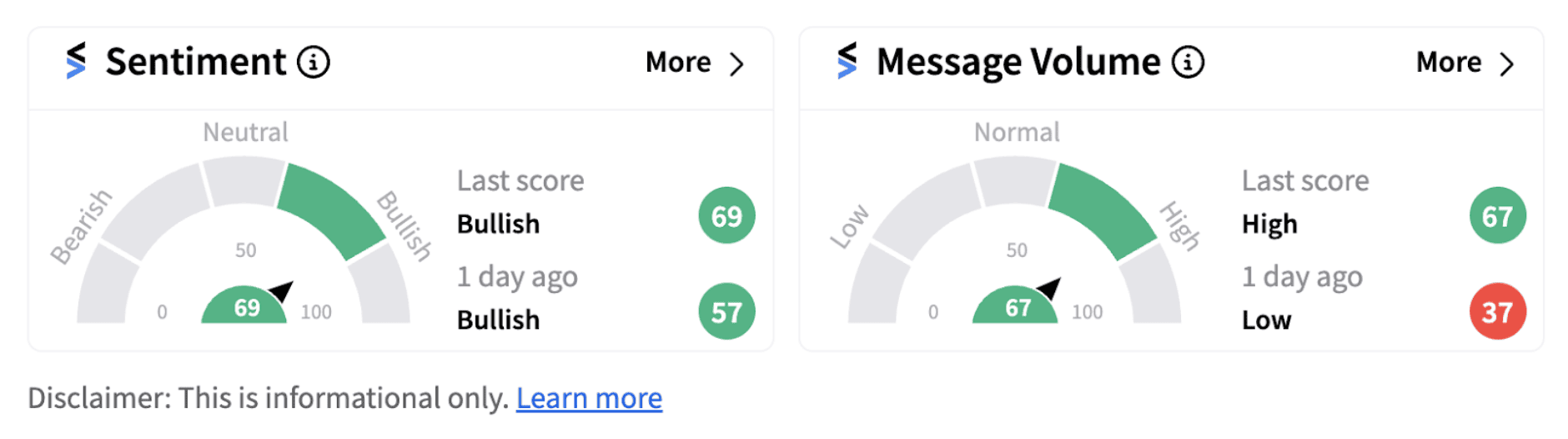

Following the announcement, retail sentiment shifted further into the ‘bullish’ territory (69/100), accompanied by ‘high’ message volumes.

Intel also made a host of other announcements. The chip-maker, along with Amazon Web Services, announced a co-investment in custom chip designs under a multi-year, multi-billion-dollar framework covering product and wafers from Intel.

The company will produce an AI fabric chip for AWS on Intel 18A, the firm’s most advanced process node. The chip-maker will also produce a custom Xeon 6 chip on Intel 3.

Intel also clarified that it is implementing plans to reduce or exit about two-thirds of its real estate globally by the end of the year. The firm is selling part of its stake in Altera, the firm’s programmable chip business.

Adding to the host of good news, came the $3 billion funding under the CHIPS and Science Act for the U.S. government’s Secure Enclave program.

Following the developments, bullish Stocktwits users expressed optimism on the stock. One user named ‘Shungy’ believes the stock could hit the $25 mark very soon.

Also See: Microsoft Stock Rises On $60B Buyback Program, Dividend Hike: Retail Gets More Bullish

/filters:format(webp)https://news.stocktwits-cdn.com/large_Altcoins_ff3521c963.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244475103_jpg_13c45a71c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Coinbase_ed6fc0a54f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jim_Cramer_82051b390e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Black_Rock_Bitcoin_I_Shares_25784fa2dc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_891861286_jpg_f5527520c5.webp)