Advertisement|Remove ads.

Interface Stock Falls Pre-market After Q4 Revenue, Guidance Fall Short Of Wall Street Projections: Retail’s On The Fence

Shares of flooring company Interface, Inc. (TILE) declined as much as 6% in Tuesday’s pre-market session, headed toward their worst single-day session in two years after the firm’s fourth-quarter revenue and guidance fell short of Wall Street expectations. The stock has since recovered significantly but continued to trade in the red before the opening bell.

Revenue for the fourth quarter (Q4) rose 3% year-over-year (YoY) to $335 million but fell below a Street estimate of $340.51 million.

Adjusted earnings per share (EPS) came in at $0.34 compared to an estimated $0.29. Net income rose 11.9% YoY to $21.8 million.

Although revenue dipped below analyst expectations, what appears to have spooked investors is the first-quarter (Q1) and 2025 guidance falling short of Street estimates. The company expects Q1 net sales at $290 million to $300 million, while analysts estimated the metric at $305.30 million.

Similarly, for 2025, the company projected net sales at $1.315 billion to $1.365 billion, while Wall Street estimated a figure of $1.368 billion.

Interface noted that given the strength of the U.S. dollar compared to other foreign currencies, it expects translation foreign exchange (FX) to negatively impact its year-over-year net sales growth rate by approximately 2% in Q1 2025 and approximately 1% to 2% for the full fiscal year 2025.

CFO Bruce Hausmann highlighted that in 2024, the company repaid $115 million of debt, reducing net leverage to 1.1 times fiscal year 2024 adjusted earnings before interest, tax, depreciation, and amortization (EBITDA).

“We made tremendous progress expanding gross profit margins which grew 174 basis points year-over-year driven by higher volumes and favorable mix, as well as lower input costs,” he said.

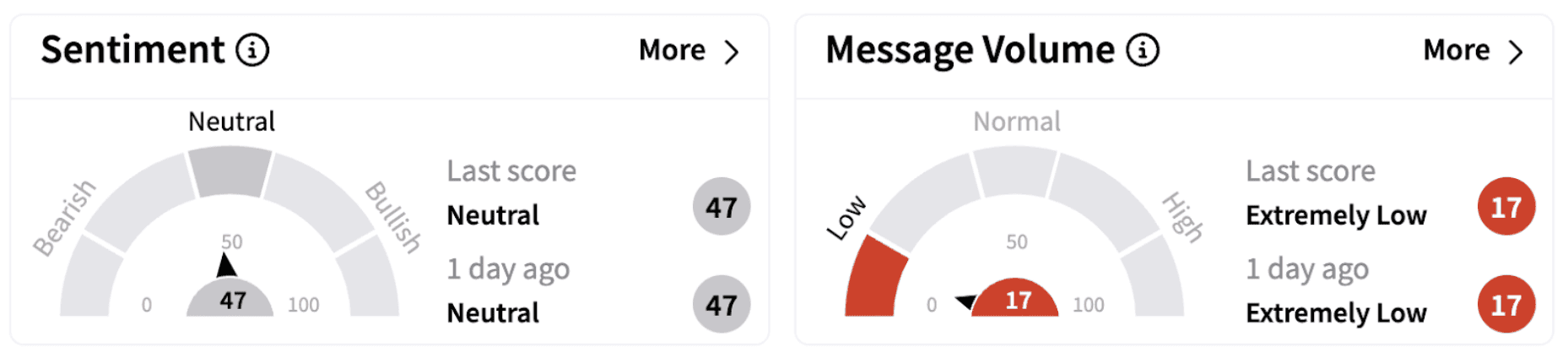

Meanwhile, on Stocktwits, retail sentiment continued to trend in the ‘neutral’ territory (47/100).

TILE shares have lost over 11% in 2025 but are up over 60% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246553876_jpg_6597db9167.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235797357_jpg_2c6f3265ce.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kevin_o_leary_OG_jpg_2789641a97.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_lights_original_jpg_db38183cfe.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_ibm_signage_mwc_resized_28f91e1a63.jpg)