Advertisement|Remove ads.

Primoris Services Stock Jumps After The Bell As 2025 Forecast Impresses Wall Street, Retail’s Bullish

Primoris Services Corp (PRIM) stock rose 10.7% in aftermarket trade on Monday after the specialty construction and infrastructure firm forecasted 2025 earnings above Wall Street’s projections.

The company forecast adjusted earnings per share in the range of $4.20 to $4.40 per share for this year, while analysts, on average, expect it to post $4.04 per share, according to FinChat data.

During the fourth quarter, the company reported adjusted earnings of $1.13 per share, which exceeded Wall Street’s expectations of $0.75 per share.

The infrastructure services firm’s quarterly revenue of $1.74 billion, topped analysts’ estimated $1.59 billion.

Its fourth-quarter utilities segment revenue rose 15.2% to $87.6 million due to higher activity in communications, gas operations, and power delivery compared to the year-ago quarter.

Primoris said its energy segment revenue jumped 15.6% to $148.1 million, aided by increased renewables activity, partially offset by lower pipeline activity.

The company’s total backlog hit a record $11.9 billion as of Dec. 31, compared with $10.9 billion at the end of 2023.

The company acknowledged that uncertainty exists regarding inflation, supply chain constraints, and changing trade and regulatory policies.

“We are confident in our ability to adapt to these potential opportunities and challenges and grow profitably,” CEO Tom McCormick said.

The company estimated capital expenditures for 2025 in the range of $90 to $110 million.

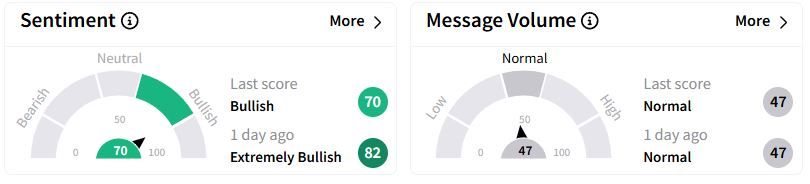

Retail sentiment on Stocktwits moved to ‘bullish’ (70/100) territory from ‘extremely bullish’(82/100) a day ago, while retail chatter was ‘normal.’

Over the past year, Primoris stock has gained nearly 62%.

Also See: Realty Income Stock Falls Aftermarket On Tepid 2025 Forecast, Retail’s Unfazed

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2214866166_jpg_efcc3db1cd.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_original_jpg_285085becb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_rivian_jpg_24a16f95b0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)