Advertisement|Remove ads.

Intuitive Machines’ Stock Climbs On Bullish Analyst Calls After Q3 Beat, But Retail Sentiment Divided

Shares of Intuitive Machines Inc. ($LUNR) surged as much as 13% at Friday’s open after analysts turned bullish on the stock following the company’s third-quarter earnings beat on Thursday.

Cantor Fitzgerald, Canaccord, Benchmark, and Roth MKM all raised their price targets for the space exploration company, with projections ranging from $12.50 to $16.

The analysts highlighted the significance of the company's upcoming lunar missions — IM-2 in 2025, IM-3 in 2026, and IM-4 in 2027 — which are seen as key to validating critical technologies like water-hunting infrastructure, boosting long-term revenue potential.

Canaccord and Roth MKM pointed to Intuitive Machines’ robust backlog and impressive revenue growth as key factors in positioning it for sustained success, particularly within the expanding space infrastructure market.

Roth MKM raised its price target to $15 from $10 with a ‘Buy’ rating.

Canaccord also gave a ‘Buy’ rating and lifted its target to $12.50 from $11, citing a strong backlog and favorable long-term revenue outlook driven by upcoming missions.

This, Canaccord notes, positions Intuitive Machines ahead of its government contractor peers.

Benchmark’s Josh Sullivan echoed a similar sentiment, raising the target to $16 from $10 with a ‘Buy’ rating, noting the company’s strong commercial model and its potential advantages under President-elect Donald Trump’s administration.

Meanwhile, Cantor Fitzgerald’s Andres Sheppard lifted his price target for Intuitive Machines to $15 from $10 while maintaining an ‘Overweight’ rating.

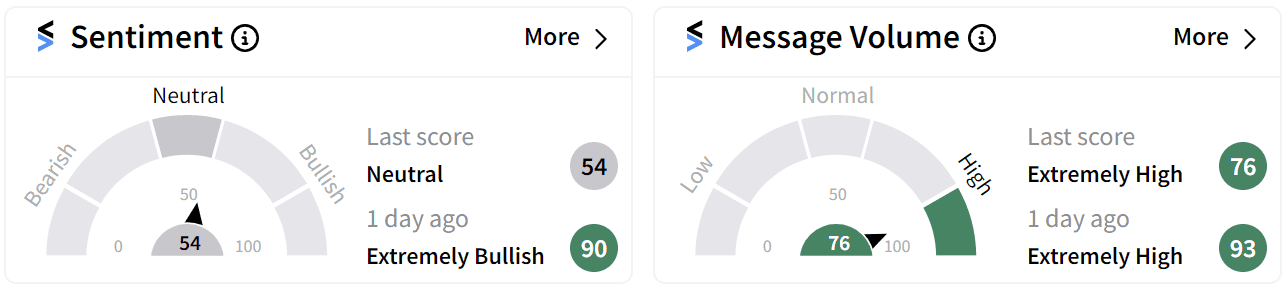

Retail sentiment around the stock has simmered into the ‘neutral’ zone from ‘extremely bullish’ a day ago with sustained message volumes trending in the ‘extremely high’ range.

Friday’s uptick comes after Intuitive Machines’ stock experienced significant volatility the day before, trading between a high of $14.90 and a low of $10.11, with a trading halt in between, before ultimately closing with an 11% gain.

The volatility came after the company revised its full-year revenue forecast downward, despite reporting a four-fold increase in revenue for the third quarter.

Intuitive Machines’ stock has more than doubled in value this year with gains of 390% so far in 2024.

For updates and corrections email newsroom@stocktwits.com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Service_Now_logo_jpg_c0da5348e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_jpg_dcfe443bb4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_doordash_jpg_6a0ffd4b33.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_eric_trump_OG_jpg_19bc149869.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)