Advertisement|Remove ads.

IOC Stock: SEBI RA Prabhat Mittal Spots Bullish Momentum, Eyes Breakout To ₹165

Indian Oil Corporation (IOC) shares surged nearly 5% on Friday on back of a solid fourth-quarter (Q4) earnings report.

The state-run oil refiner reported a 50% year-on-year rise in net profit to ₹7,265 crore, while revenues stood at ₹2.18 lakh crore.

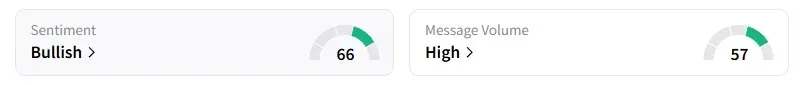

Data on Stocktwits shows that retail sentiment turned ‘bullish’ a week ago.

Prabhat Mittal notes that Jefferies revised its price target for IOC to ₹160.

He observes that, from a technical perspective, the stock is forming an upward sloping channel on the short-term chart and is currently trading above its 20, 50, and 100-day moving averages. Additionally, the MACD indicator is providing a buy signal.

With the stock trading over 4% higher at ₹144, Mittal believes that a breakout above ₹145 could propel the price up to ₹165.

He suggests that traders should consider buying above ₹145, with a strict stop loss at ₹139, targeting a move to ₹165.

Anupam Bajpai notes that IOC was trading at similar levels in December 2024.

He highlights that the stock is now moving towards its 200-day moving average, which often acts as a significant support and resistance level for price action.

With the recent breakout above ₹139.68, Bajpai believes this signals the potential for further price appreciation.

He also points out that the Relative Strength Index (RSI) is at 70, indicating strong momentum in the stock.

IOC shares gained 4% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)