Advertisement|Remove ads.

IonQ Stock Rises After $1.1B Oxford Ionics Acquisition, But Retail Remains Wary

Shares of IonQ Inc. (IONQ) traded 4% higher in Monday’s premarket after the company agreed to acquire U.K.-based quantum computing innovator Oxford Ionics in a deal worth approximately $1.075 billion.

The acquisition, which includes $1.065 billion in IonQ shares and approximately $10 million in cash, is designed to combine complementary quantum technologies and strengthen the companies' global research and development (R&D) footprint.

The merged entity aims to deliver the most powerful quantum computing systems ever built.

Oxford Ionics, known for achieving record-setting quantum fidelity levels, will bring its ion-trap technology, built using standard semiconductor fabrication, into IonQ’s ecosystem.

IonQ views the acquisition as a springboard for rapid advancements across various industries, including aviation, financial services, and pharmaceutical development.

The merger aims to combine IonQ’s strengths in software and quantum applications with Oxford’s expertise in hardware, paving the way for systems that are easier to scale, deliver higher precision, and are better suited for commercial use.

The roadmap outlines milestones, including achieving 256 physical qubits within the next year and scaling up to as many as two million qubits by 2030, while targeting logical error rates that approach near-perfect accuracy.

The agreement also aligns with broader geopolitical goals, strengthening collaboration between the United Kingdom and the United States in advanced technological research.

Oxford Ionics founders Chris Ballance and Tom Harty are expected to remain in leadership roles after the merger.

“Today’s announcement of our intention to acquire Oxford Ionics accelerates our mission to full fault-tolerant quantum computers with 2 million physical qubits and 80,000 logical qubits by 2030,” said CEO of IonQ, Niccolo de Masi.

IonQ intends to retain all current customer relationships and continue working with government partners on both sides of the Atlantic.

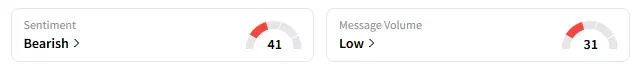

On Stocktwits, retail sentiment around IonQ remained in the ‘bearish’ territory.

A Stocktwits user felt the company is way overvalued.

IonQ stock has lost over 6% year-to-date and has gained nearly four times in the last 12 months.

Also See: Nvidia-Backed Nebius Draws Retail Buzz With UK AI Data‑Centre Plans

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_tariffs_jpg_d7661eb31a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347257_jpg_81c3539d3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2204003106_jpg_405e036a7c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_peter_tuchman_jpg_fb781e7355.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)