Advertisement|Remove ads.

IonQ Stock Slides After Kerrisdale’s Short Report Slams ‘Absurd’ Revenue Multiple: Retail’s Unswayed

IonQ, Inc. (IONQ) stock slipped after Kerrisdale Capital issued a short report on the manufacturer of high-performance quantum computers.

In a blogpost on its website, the short seller said, “We are short shares of IonQ, a $5 billion quantum computing company whose stock has tripled in recent months as retail investors, chasing the “next AI” trade, piled into an industry that has long been plagued by overpromises and hype.”

Kerrisdale noted that despite the stock pulling back from its all-time highs, it is still trading at a “staggering” multiple of 40 times the consensus 2026 revenue estimate. According to the firm, the valuation defies logic.

The firm also noted that former IonQ employees have flagged “monumental” scaling challenges that will derail the company’s ambitious plans.

Kerrisdale thinks IonQ is far from the cusp of a “new era of commercial success” due to its limited error-prone systems.

The firm expressed skepticism regarding the company's exponential growth claims, as it seeks to grow from 80 to 100 physical qubits to over 4,000 by 2026 and 32,000 by 2028. It also called out the management’s lack of transparency.

“A cash-burning, highly promotional company in a hot sector valued at absurd revenue multiples, with retail investors piling in and ignoring critical scaling challenge – even as the CEO unloads $37m worth of stock – are hallmarks of a disaster in the making,” said Kerrisdale.

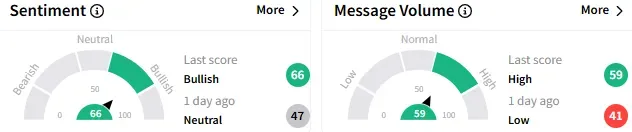

On Stocktwits, retail sentiment toward IonQ stock flipped into the ‘bullish’ (68/100) territory from ‘bearish’ a day ago. The message volume improved to ‘high’ amid the short report.

A bullish watcher rubbished the short report, calling Kerrisdale a “great scam.”

Another user said he would buy more shares, citing quantum computing’s long-term potential.

IonQ stock fell nearly 4% to $20.97 by the mid-session on Thursday. For the year-to-date period, the stock has lost about 48%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_moonlake_jpg_376bc698df.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vlad_tenev_robinhood_CEO_OG_jpg_bf3a4c4bee.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Deere_resized_a913c16f0a.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_b2gold_jpg_2d344842dd.webp)