Advertisement|Remove ads.

Pre-Market Movers: IOVA, AVXL, ASTS Catch Retail’s Eye

Retail investors are honing in on three lesser-known stocks before the opening bell, according to Stocktwits data. Market participants are focused heavily on big-tech earnings and the Fed’s rate cut decision this week, but news for these three stocks is taking precedence in early trading.

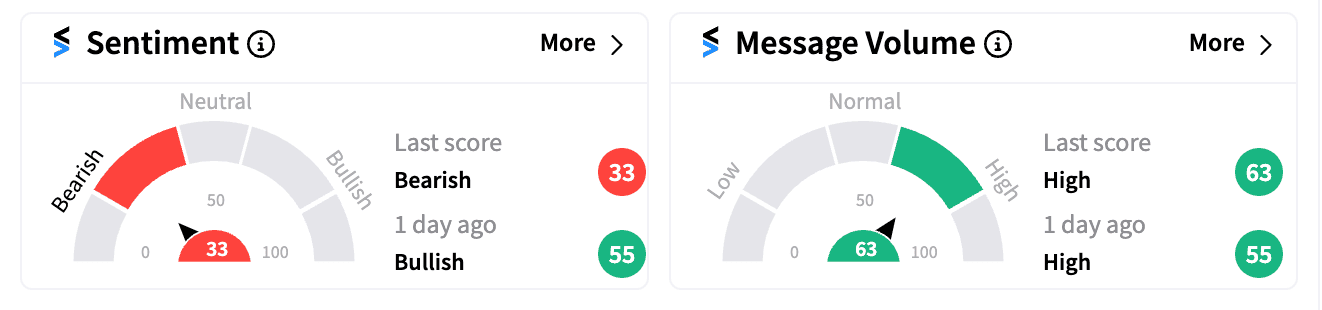

Iovance Biotherapeutics Inc. (IOVA): The biopharma company's stock price dipped over 10% to $8.30 pre-market after a Piper Sandler downgrade from Overweight to Neutral and a price target reduction from $19 to $10. Stocktwits sentiment mirrored the analyst's shift, flipping from bullish a day ago to bearish (33/100) as at 8.30 am ET. The downgrade stemmed from concerns about the slow adoption of IOVA's recently approved melanoma treatment, Amtagvi.

Analyst conversations with treatment centers revealed only 10-15% of eligible patients received the infusion so far due to manufacturing limitations. Consequently, Piper Sandler’s Q2 revenue forecast for Amtagvi has been halved from an earlier consensus estimate of $24 million. The full-year revenue forecast has also been cut.

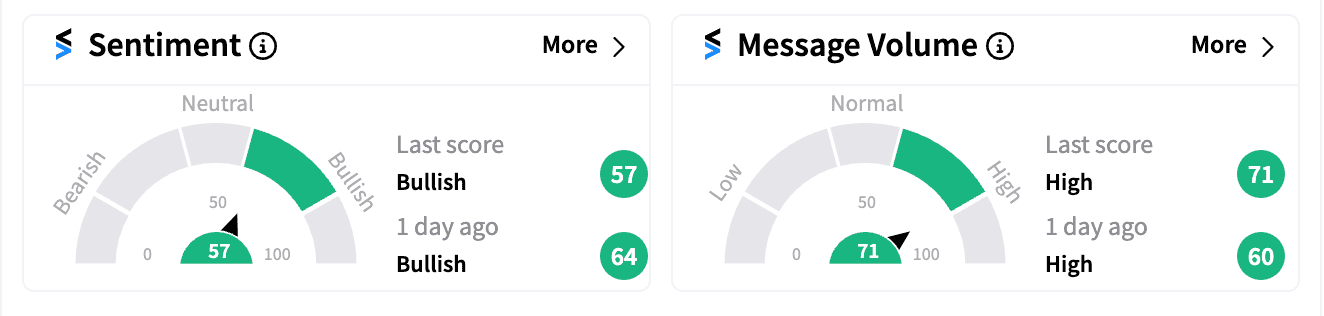

Anavex Life Sciences Corporation (AVXL): Shares of the neuro-disease focused biopharma company surged nearly 14% to $7.68 pre-market, following data from the company showing that its oral Alzheimer's treatment, Blarcamesine, slowed clinical decline in early-stage patients. This development follows EF Hutton's initiation of coverage last week with a Buy rating and a $46 price target, representing a nearly 500% upside potential.

Additionally, the company's lead therapy, ANAVEX2-73, remains on track for regulatory submission by year-end. Retail investor sentiment on Stocktwits remained bullish (57/100) with high message volume, reflecting continued investor interest.

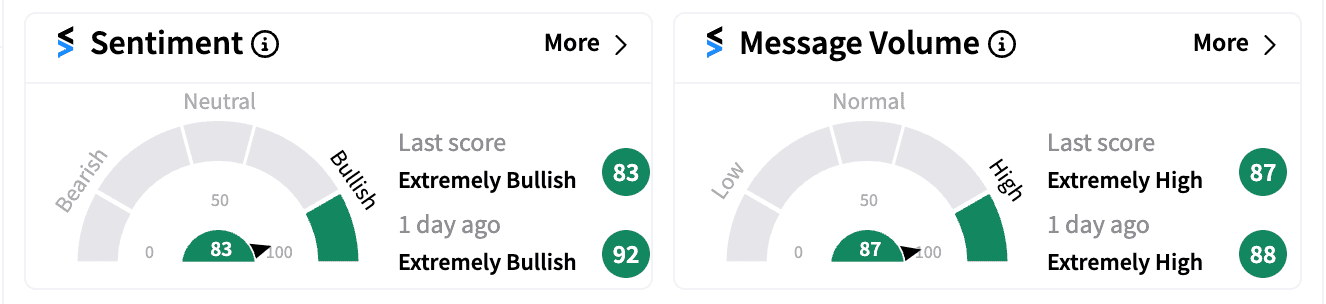

AST SpaceMobile Inc. (ASTS): The space communications start-up's shares dipped slightly by 1.80% to $18.50 pre-market following last week’s 44% rise. ews of completing construction and testing of its first five Bluebird communications satellites, which are reportedly scheduled for shipment to Cape Canaveral next month for a September launch by SpaceX.

Notably, AST has secured investments from major technology and telecommunication giants like Verizon, Google (Alphabet), and a new U.S. government contract through a prime contractor. Retail investor sentiment on Stocktwits remained extremely bullish (83/100) with very high message volume, mirroring trends from the previous session. Popular posts on the platform focused on upcoming catalysts like CEO Abel Avellan's conference appearance later this week, potential FCC approval updates, and launch timeline developments.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1289252849_jpg_5041bcf62e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2021/02/paypal2.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bulls_versus_bears_stock_market_jpg_c083ddc168.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_Jensen_Huang_jpg_c64c858674.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump2_jpg_ad63f384b5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_johnson_johnson_logo_resized_eaf5f62dff.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)