Advertisement|Remove ads.

IREDA Stock Hits Nearly 2-Month High After Strong Q4 Earnings: Retail Sentiment Peaks

Indian Renewable Energy Development Agency (IREDA) shares surged over 5% on Wednesday to hit highs last seen in late February, driven by robust fiscal fourth-quarter earnings, lifting retail investor sentiment.

IREDA reported an impressive 49% year-on-year (YoY) increase in consolidated net profit, amounting to ₹502 crore, alongside a 37% rise in revenue from operations to ₹1,905 crore.

Profit before tax (PBT) surged by 31% to ₹629 crore during the March 31, 2025 quarter.

The company's loan book expanded significantly, growing 28% YoY to ₹75,319 crore, reflecting its robust lending operations in the renewable energy sector.

Despite these gains, IREDA's asset quality showed some deterioration. Net non-performing assets (NPAs) rose from 0.99% in Q4 FY24 to 1.35% in Q4 FY25, while gross NPAs stood at 2.45%.

However, this did not dampen investor sentiment as the company's growth trajectory remains strong.

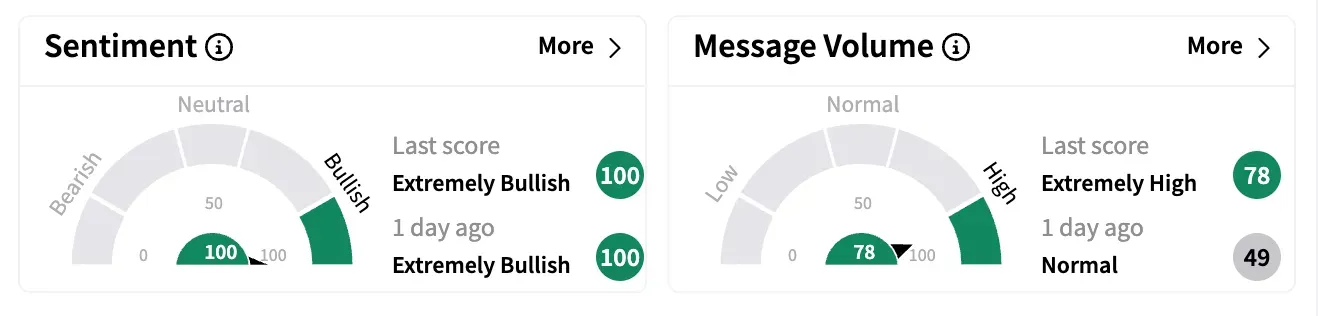

Data from Stocktwits showed retail sentiment remaining 'extremely bullish', hitting the highest possible level, amid a jump in message volume.

One user said the market liked the strong Q4 results.

The market response reflects growing confidence in its long-term potential as a key player in the green energy sector.

However, IREDA is down 18.30% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_jeff_merkley_jpg_aca807f10f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230437216_jpg_6078a75ee4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2149037439_jpg_ab9f73d5f7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2205870374_jpg_15fedc8d2f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_berkshire_hathaway_jpg_86250c27d6.webp)